Viridian Capital Believes Long Term Debt Of Top MSOs ‘Arguably Unsustainable’ In 280e World

The cannabis industry is facing challenges in terms of leverage and credit quality as companies grapple with regulatory and financial constraints. Viridian Capital Advisors (VCA) examined certain key indicators and data from leading cannabis companies to gain insights into their debt levels and overall creditworthiness. VCA also explores the need for re-equitization and the current state of the industry.

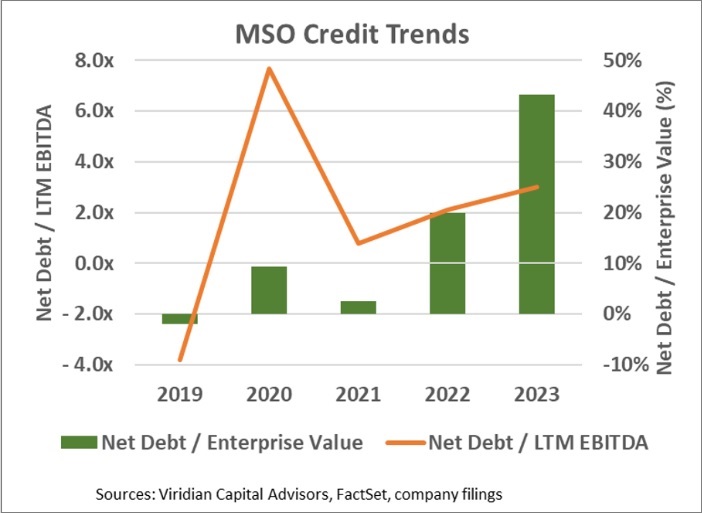

To gauge leverage and credit quality in the cannabis sector, VCA analyzed two important indicators: Net Debt/LTM EBITDA and Net Debt/Enterprise Value. The data presented focuses on Memorial Day figures, utilizing net debt and LTM EBITDA from the March quarter for each year. LTM is an acronym for last twelve months.

The companies included in the analysis are Ascend Wellness, AYR Wellness, Columbia Care, Cresco, Curaleaf, 4Front Ventures, Green Thumb Industries, Jushi Holdings, TerrAscend, Trulieve Cannabis, and Verano Holdings. Origination data for Ascend, AYR, 4Front, and Verano data was unavailable for the period of 5/24/19.

Analysis Findings

The graph illustrates the relationship between Net Debt/LTM EBITDA (depicted by the orange line) and Net Debt/Enterprise Value (shown by the green bars). As of 5/24/19, the aggregate net cash for the companies analyzed stood at $178 million, with only TerrAscend and Trulieve carrying net debt. In 2020, net debt increased to $938 million, equivalent to 7.7x LTM EBITDA of $122 million. However, net debt remained below 10% of enterprise value.

Memorial Day 2021 marked the peak of aggregate cannabis credit quality, with Net Debt/LTM EBITDA at 0.77x and Net Debt/Enterprise Value at 2%, which is still quite low.

However, over the past two years, aggregate credit quality in the cannabis industry has deteriorated. Due to limited equity financing options, MSOs (multi-state operators) have increasingly turned to debt financing. At the same time, inflation and wholesale price pressures have hindered EBITDA growth. Net debt has risen by 31% to $5.4 billion compared to $4.1 billion last year, while LTM EBITDA has declined by 7% to $1.8 billion from $1.94 billion last year. The Net Debt/LTM EBITDA ratio now stands at 3.0x for the group.

Dynamics Need To Change

To address the current situation, VCA believes a re-equitization is necessary. However, this challenging with an industry currently trading at an enterprise value of only $12 billion, down from $38 billion on Memorial Day 2021. In turn, the EV/LTM EBITDA ratio is now at 6.8x, significantly lower than the over 20x figure seen in 2021. This, despite the industry’s potential catalysts such as the SAFE Act, rescheduling/descheduling, or individual state 280e reform.

Debt remains the primary financing option in the near term, but there are limits. Careful credit analysis becomes crucial for cannabis investors as they navigate this challenging landscape. While VCA believes the industry holds immense potential, the lack of tangible catalysts and limited financing options highlight the need for cautious credit analysis in cannabis investments.

Of course, many of these concerns could be remedied with various cannabis reform introduced in Congress. Ultimately, it will be up to the politicians to change these dynamics and see this through—before the major MSOS hit a debt wall.