Mind Medicine Inc.: The Next Speculative Psychedelics Unicorn?

It’s happening. Medicinal psychedelics (non-cannabinoid based) is about to elbow further into investor consciousness as Mind Medicine Inc.—a company undertaking the clinical trial of psychedelic-based drugs—goes public on the NEO in early March. Unlike the smattering of acquire-in psychonaut companies on various exchanges, MindMed is backed by star financier power. This practically guarantees the sector’s profile will increase upon its listing.

TDR looks into the go-public lead up and qualitatively assesses MindMed’s potential as the next Canadian capital markets unicorn.

MindMed – How It Got Here

The genesis of MindMed’s soon-to-be public roots traces back to July 2019, when the company announced a proposed reverse takeover (RTO) agreement of Broadway Gold Mining (consummated October 2019). The agreement calls for several classes of outstanding MindMed shares to be consolidated into Class ‘A’ shares and subsequently exchanged on a one-to-one basis for securities of Broadway. Broadway will consolidate its outstanding shares, warrants and options on an 8-to-1 new common share basis and change its name to the aforementioned. It will also amend its capital structure by creating a new class of multiple voting shares carrying 100 votes per share.

Additionally, Broadway will spin-out to existing shareholders all of the mining assets related to its Broadway and Madison mine and the Tsumeb land package in Namibia.

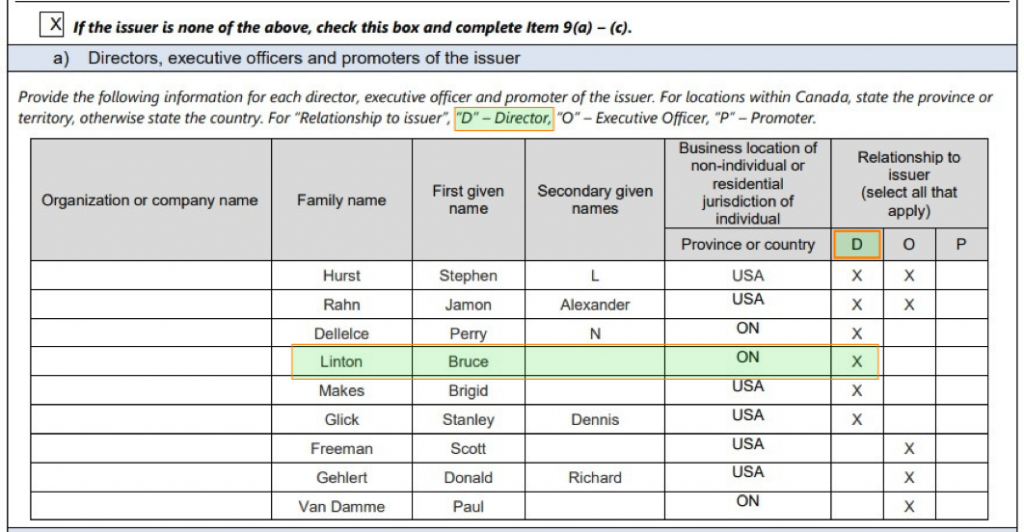

Spearheading this endeavor was a financing round that netted MindMed $6.2M in September 2019, lead by former Canopy Growth CEO Bruce Linton and celebrity entrepreneur Kevin O’Leary. Unlike the latter, Mr. Linton has a place on the Board of Directors, so he will maintain an active advisory role.

On December 19, 2019, MindMed completed the first tranche of its brokered private placement (BPP) financing of Class D non-voting shares of MindMed at a price of CAD$0.33 per share for gross proceeds of $6,194,726. The closing of a second tranche to raise an aggregate C$15.0M was anticipated on or about February 11, 2020, however, that transaction has not yet been fulfilled.

The target valuation upon listing is reported to be approximately $50 million, according to co-founder/CEO Jamon R. Rahn. The stock will trade under the ticker ‘MMED’.

Bringing Legitimacy To The Space

Aside from some high profile backing, MindMed appears to have certain differentiators that will likely pique investor interest.

Unlike the small handful of psychedelic wellness wannabes, MMEN has advanced therapeutic agents trialing beyond the pre-clinical phase. The company’s lead agent 18-MC (18-methoxycoronaridine; non-hallucinogenic version of the psychedelic compound ibogaine)—opportunistically purchased from Savant HWP in June 2019—has already gone through a successful Phase I trial backed by $6.5M in National Institute of Drug Abuse (NIDA) grant funding (2012). Phase I is the first set of studies to determine the safety and efficacy of the drug in humans.

Now it’s onto Phase II trials involving well-controlled studies with larger populations. The study will target opioid use disorder—an insidious epidemic responsible for tens of thousands of deaths in North America annually.

MindMed is also simultaneously preparing a Phase II clinical trial using LSD (Lysergic Acid Diethylamide) to target Attention Deficit & Hyperactivity Disorder (ADHD). Current mainline drug treatments—amphetamines (Adderall) and methylphenidate (Ritalin)—have many well-documents risks associated with continued use.

To put MindMed’s leadership position into context: perhaps the best known psychedelics-focused company on Canadian exchanges—Revive Therapeutics Ltd.—has yet to submit its Investigational New Drug (IND) application to the FDA for the treatment of Autoimmune Hepatitis (expected Q2 2020). A Pre-IND meeting with the FDA for Psilocybin in treatment of mental illness is also anticipated next quarter.

Another promising psychedelics wellness company—UK based Compass Pathways Ltd.—is engaged in Phase IIb trials of psilocybin therapy for treatment-resistant depression. However, it is not a public company.

Although MindMed will assume publicly-listed psychedelic wellness leadership by default—pending the small batch of new issues expected to list on Canadian exchanges this year—it isn’t through some rag tag acquire-in scheme. The scientific portfolio has promise and is being directed by Stanley Glick, the Albany Medical Center researcher who has been working with 18-MC since the 1990’s. Finally, he will receive the proper funding to see his research through to its ultimate conclusion.

MindMed’s IPO Drops—What Comes Next

We can only speculate how MMED will perform in its first trading quarter (generally, the minimum lockup period prior to the 1st unlock of private round equity). So many variables determine the success of an issue at outset, making it impossible to predict outcomes in any sort of formulaic calculation. We can only make qualitative judgments based on experience, underlying interest of stock and industry, general risk on/off market sentiment and performance of recent new issues.

To that end, MMED appears to check off most of the boxes.

- With MindMed taking a de facto leadership position among exchange-traded psychedelic companies, it is likely to attract capital from investors looking for sector exposure

- TDR believes Canadian investment bank and retail sentiment is mostly aligned as it pertains to psychedelic’s potential as the next hot investable sector—similar to cannabis circa 2014. While there’s rigorous debate regarding the breadth/scope of each (biotech vs. split CPG/wellness focus), the prospect of asymmetrical returns for early investors will attract its fair share of capital

- Notwithstanding the cannabis-heavy S&P/TSX Venture Pharmaceuticals Biotechnology & Life Sciences Index—down 56.28% over the past year—investors have selectively supported speculative junior niche wellness stocks

As recent proof, we reference American Aires Inc. (WIFI:CNX)—a company engaged in the production, distribution and sales of electromagnetic protection devices. WIFI began trading on the Canadian Securities Exchange on November 7, 2019.

With just $138,207 in revenues against $389,599 in net losses for the latest quarter (September 30, 2019), there seemed little to get excited about upon issuance. Yet, the stock managed to rise ↑150% between November 7-January 13 from its last go-public round pricing. Why? Because WIFI addresses a niche ‘wellness’ market by producing goods that protect against the perceived dangers of ‘5G’ electromagnetic radiation. Along with positive catalysts to carry it forward, WIFI was able to generate investor interest and maintain price momentum.

As MindMed will not be generating material revenues for many years—if ever pending clinical outcomes—robust price action will depend on similar dynamics.

We also reference the strong performance of Antibe Therapeutics Inc., a developer of safer non-addictive medicines for pain and inflammation. The company’s lead nonsteroidal anti-inflammatory drug (NSAID), ATB-346, is currently in advanced Phase IIB trials. While Antibe has been publicly listed for years, the stock has nonetheless doubled in the past six months in anticipation of positive results.

Finally, we reference the large recent gains in Tetra-Bio Pharma Inc., the junior biopharmaceutical company engaged in the development of cannabinoid-based compounds. The company recently rose ↑233.33% between November 20, 2019 & January 17th—albeit off depressed levels—initially driven by FDA advancement of its previously discontinued clinical trial of investigational therapeutic QIXLEEF (PPP001). In that two month window, Tetra Bio-Pharma disseminated no less than ten separate press releases.

The moral of these examples: ultra-speculative growth stocks are primarily influenced by news-driven events. Rightfully or wrongfully, a prime consideration for staking an early position—beyond the usual considerations—is ascertaining whether a company and sector can produce enough material news to keep capital flowing in.

The emerging psychedelics industry, for all of its uncertainty, promises to provide just that. Early stage investing cares little about traditional fundamentals.

Final Thoughts

Although we can only speculate how MMED will perform in its first quarter of trade, TDR believes the odds favor a robust bid in the near term. As a de facto leader among psychedelic publicly listed companies—backed by strong founders, promising research and sector profile on the upswing—the ingredients are present for bursts of speculative fervor. As we’ve documented, recent junior price action is proof that speculative capital can carry niche ‘wellness’ (tech and biopharma) stocks on a select basis.

Obviously, such sentiments must be checked by the stark reality inherent to all junior biotech companies. That is, odds of taking therapeutic compounds from early clinical stages through to New Drug Application (NDA) status are rare; only 20-30% of Phase III trials ultimately make the grade. While MindMed has two compounds in Phase II trials, a long and improbable journey towards commercialization lies ahead.

If anything, the cannabis bubble sixteen months prior taught us that a market can sustain itself with the proper mix of headline driven news and positive macro sentiment. The tradeoff is extreme directional volatility, but few will be staking their life savings on it. Proportional capital risk allocation is key.

Perhaps Kevin O’Leary said it best in a December 9, 2019 Fast Company article profiling Mind Medicine: “This is one of these binary investments… extraordinary returns, or zero.”

We couldn’t have said it better ourselves. Please invest accordingly.