Fed Chair Jerome Powell Tells Congress Interest Rates Will Need To Rise More Than Expected

The “disinflation” that the Federal Reserve spoke of a few weeks ago appears to have been premature. On Tuesday, Fed Chair Jerome Powell told Congress that the Federal Reserve will need to raise its key interest rate more than anticipated, much to the chagrin of consumers everywhere.

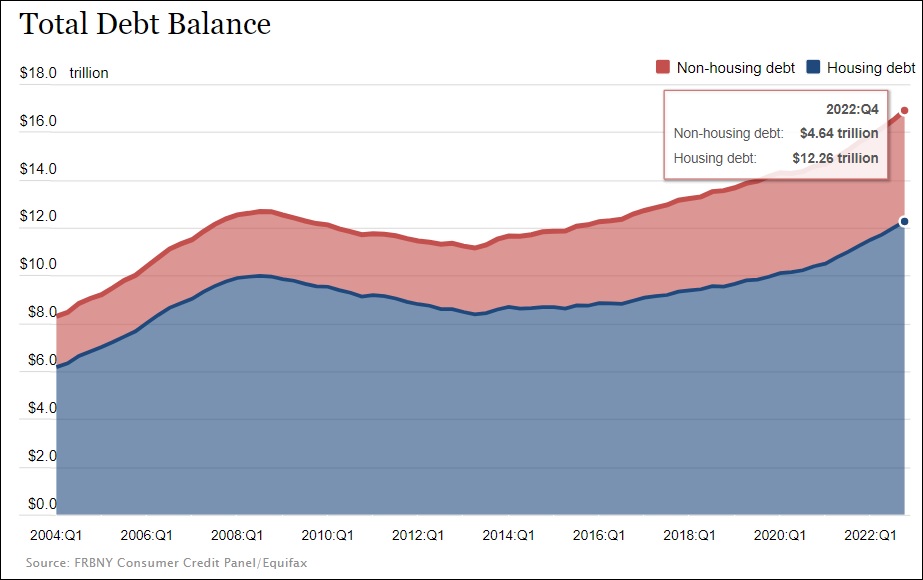

With a fed funds rate that already in the target range of 4.5% to 4.75%, raising it above 5% and above could have an impact on the pockets of consumers and what they would pay in interest on their credit cards, mortgages and other types of loans.

For example, credit card interest rates, are at their highest levels since 1994 and in many cases are around 22%. This while credit card debt owing has just eclipsed $1 trillion to record highs.

“The latest economic data came out stronger than expected, suggesting that the level that interest rates will reach is likely to be higher than anticipated,” Powell said in remarks before the Senate banking committee.

“If the totality of those numbers indicates that more rapid tightening is required, we are prepared to accelerate the pace of rate hikes,” he added.

Jerome Powell’s remarks served as a clear indication that while the Federal Reserve has been pumping the brakes on the pace and scope of interest rate hikes, it will have no qualms increasing again to reign the economy in as required. Furthermore, they signal observers and stakeholders to expect more rate hikes in the future, even if they remain in the range of 25 basis points.

The U.S. economy has remained surprisingly resistant considering the pace of hikes. Consumption and the labor market remain robust despite the fact that rates have been raised to levels not seen since 2007.

In fact, the process of “disinflation”—a persistent slowdown in inflation—that the Fed had considered “started” is not showing the consistency envisioned. The recent numbers “have partially reversed the downward trends we had seen just a month ago,” Jerome Powell said.

Recent figures from the Fed’s preferred inflation gauge showed that consumer prices had their biggest rise in seven months from December to January. Furthermore, reports on hiring, consumer spending and macroeconomic trends indicate that economic growth remains robust.

In the coming days, the official reports on employment and inflation will be crucial, which the Fed will take into account to decide how much to raise the benchmark rate again at its meeting on March 21 and 22.