TDR’s U.S. Stock Market Preview For The Week Of August 8, 2022

A weekly stock market preview and the data that will impact the tape.

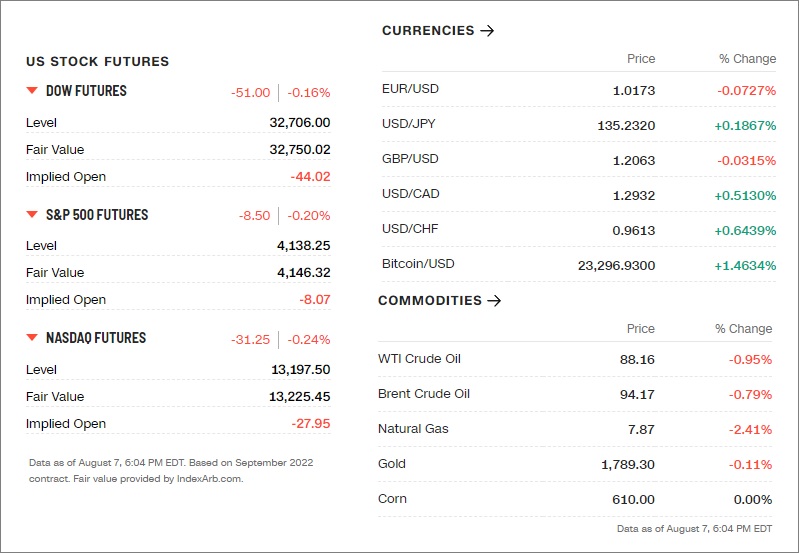

Sunday Evening Futures Open – Stock Market Preview

Weekend News And Developments

Berkshire Hathaway dramatically slowed new investment in the second quarter after setting a blistering pace at the start of the year, as the US stock market sell-off pushed the insurance-to-railroad conglomerate to a $43.8bn loss.

China’s southern island province of Hainan started mass Covid-19 testing on Sunday, locking down more parts of the province of over 10 million residents, as authorities scramble to contain multiple Omicron-driven outbreaks, including the worst in capital Sanya, often called “China’s Hawaii”.

Cuba: 17 missing, 121 injured as fire rages in oil tank farm in Matanzas City

Equity positioning for both discretionary and systematic investors remains in the 12th percentile of its range since January 2010, according to Deutsche Bank published last week.

Fisker Inc. (NYSE:FSR) unveils a process for qualifying US-based reservation holders of the Fisker Ocean all-electric SUV to retain access to the existing federal tax credit. The current $7,500 tax credit would be unavailable should Congress pass the Inflation Reduction Act of 2022 and President Biden signs the legislation into law.

Former Labour prime minister Gordon Brown has called for an emergency budget before the UK hits a “financial timebomb” this autumn. Mr. Brown said millions would be pushed “over the edge” if the government does not address the cost of living crisis.

Israel said Sunday it killed a senior Islamic Jihad commander in a crowded Gaza refugee camp, the second such targeted attack since launching its high-stakes military offensive against the militant group just before the weekend. The Iran-backed militant group has fired hundreds of rockets at Israel in response, raising the risk of the cross-border fighting turning into a full-fledged war.

NexJ Systems (TSX: NXJ) announced financial results for its second quarter ended June 30, 2022.

Rhine river hit by drought conditions, hampers German cargo shipping. According to reports, transport prices have shot up as drought and hot weather have affected water levels in the river Rhine in Germany leading cargo vessels to reduce loads during transportation.

Taiwan’s defense ministry said it had detected 66 Chinese air force planes and 14 Chinese warships conducting activities in and around the Taiwan Strait on Sunday, Reuters reports. Thursday’s drills involved the live firing of 11 missiles.

Unifor: 1,800 members from across the country arrive in Toronto this weekend before Monday’s start to the union’s 4th Constitutional Convention, where delegates will elect a new National President and vote on key priorities and initiatives. Unifor is Canada’s largest union in the private sector, representing 315,000 workers in every major area of the economy.

U.S. rate futures have priced in a 69% chance of a 75 bps hike at its September meeting, up from about 41% before the payrolls data. Futures traders have also factored in a fed funds rate of 3.57% by the end of the year.

What The Analysts Are Saying…

Anybody that jumped on the ‘Fed is going to pivot next year and start cutting rates’ is going to have to get off at the next station, because that’s not in the cards. It is clearly a situation where the economy is not screeching or heading into a recession here and now.” — Art Hogan, chief market strategist at B. Riley Financial

“It is not a market bottom, things are not going to go up consistently from here because we are going to be buying low tech products for a while, so everyone has something to make up as COVID demand = pre-COVID, there are fewer units for this. Reality check – unlike ‘Big Tech’, consumer discretionary related companies are offering more cautious guidance.” — Morgan Stanley analyst commentary on a potential market bottom

“The fact of the matter is this (Aug. 5 nonfarm payroll report) gives the Fed additional room to continue to tighten, even if it raises the probability of pushing the economy into recession. It’s not going to be an easy task to continue to tighten without negative repercussions for the consumer and the economy”. — Jim Baird, chief investment officer at Plante Moran Financial Advisors

“We are surprised to not see investors start to chase upside calls in fear of underperforming the market. People are just watching.” — Matthew Tym, head of equity derivatives trading at Cantor Fitzgerald

👀What We’re Watching👀

• Psychedelic Sector Gaining Momentum: What started out as bottoming action after a protracted multi-quarter decline has now morphed into a tangible bullish impulse. We believe Netflix new docuseries How To Change Your Mind has played an important roll in the creation of critical mass awareness for the sector—and a rebound in broad market risk assets hasn’t hurt. At the tip of the spear for this sentiment shift is COMPASS Pathways plc (CMPS), which has risen 62.64% since the docuseries debuted on July 12. Price on the benchmark Horizons Psychedelic Stock Index ETF has now breached the 20-day MA/EMA.

We are watching to see if investor sentiment shifts into laggard names such as Cybin Inc. and MindMed, which has continued to fall following a proposed 15-1 reverse stock split initiative announced this year. Many Tier-2/3 names still 90%+ off their highs…

• Revive Therapeutics (RVV:CSE, RVVTF:OTC): This has been on our radar for the last couple of weeks, and remains on our watch list. The company has already confirmed that their statistician is in possession of 210 unblinded patient data for its Phase 3 clinical trial to evaluate Bucillamine to treat COVID-19. The company is currently attempting to revise endpoint data from a hospitalization/death focus to a symptoms focus. If they are to achieve this, it will mark a material event in the course of the trial.

We believe an endpoint decision, either positive or negative, is imminent and will cause a material price action event.

• Consumer Price Index, August 10: Consumer inflation expectations for July are released by the New York Fed, while the University of Michigan’s preliminary survey of consumers for August is on tap. Taken together, these should give investors a better picture of how consumers are feeling about current economic conditions.

As of June, it’s running at 9.1% on an annual basis. Investors, economists and consumers will be watching to see if price increases are easing as everything from gasoline to food is elevated.

Given the mixed signals on the overall state of the economy (i.e. indications of recession vs. this week’s strong nonfarm payrolls number), CPI will be in-focus by market participants. Scotiabank expects 8.9% y/y (9.1% prior) and 0.4% m/m for headline CPI; ex-food-and-energy: 6.1% y/y led by a 0.6% m/m gain.

• Pot stocks earnings continue, with several Tier-1/Teri-2 names reporting including Curaleaf Holdings, Trulieve Cannabis, Marimed Inc., Cronos Group, TerrAscend Corp. and more. Last Wednesday, Green Thumb Industries allayed fears somewhat that this earnings season would be a write-off, producing solid numbers which beat expectations on several key metrics. An additional strong report or two will go a long way to help improve sentiment for a sector that’s been decimated over the past six quarters.

U.S. Economic Calendar

| TIME (ET) | REPORT | PERIOD | MEDIAN FORECAST | PREVIOUS |

| Monday, August 8 | ||||

| 11:00 AM | NY Fed 3-year inflation expectations | July | — | 3.60% |

| Tuesday, Aug. 9 | ||||

| 6:00 AM | NFIB small-business index | July | 89.5 | 89.5 |

| 8:30 AM | Productivity | Q2 | -4.30% | -7.30% |

| 8:30 AM | Unit labor costs | Q2 | 9.30% | 12.60% |

| Wednesday, August 10 | ||||

| 8:30 AM | Consumer price index | July | 0.30% | 1.30% |

| 8:30 AM | Core CPI | July | 0.60% | 0.70% |

| 8:30 AM | CPI (year-over-year) | July | -8.70% | 9.10% |

| 8:30 AM | Core CPI (year-over-year) | July | 6.10% | 5.90% |

| 10:00 AM | Wholesale inventories (revision) | June | 1.90% | 1.70% |

| 2:00 PM | Federal budget (compared with year earlier) | July | — | -$302 billion |

| Thursday, August 11 | ||||

| 8:30 AM | Initial jobless claims | Aug. 6 | 265,000 | 260,000 |

| 8:30 AM | Continuing jobless claims | July 30 | — | 1.42 million |

| 8:30 AM | Producer price index | July | 0.20% | 1.10% |

| Friday, Aug. 12 | ||||

| 8:30 AM | Import price index | July | -0.80% | 0.20% |

| 10:00 AM | UMich consumer sentiment index (preliminary) | Aug. | 53 | 52 |

| 10:00 AM | UMich 5-year inflation expectations (preliminary) | Aug. | — | 2.90% |

😎Meme Of The Week😎

Key Earnings (US Markets)

| Date | Company | Symbol | Earnings estimate |

| Monday, August 8 | 3D Systems | DDD | $0.00 per share |

| Barrick | GOLD | $0.22 | |

| BioNTech | BNTX | $7.08 | |

| Energizer | ENR | $0.76 | |

| News Corp. | NWSA | $0.08 | |

| Novavax | NVAX | $5.18 | |

| Palantir Technologies | PLTR | $0.03 | |

| Take-Two Interactive Software | TTWO | $0.86 | |

| Tyson Foods | TSN | $1.97 | |

| Upstart | UPST | $0.08 | |

| Tuesday, Aug. 9 | Akamai Technologies | AKAM | $1.31 |

| Aramark | ARMK | $0.24 | |

| Bausch Health | BHC | $0.91 | |

| Carlyle Group | CG | $1.07 | |

| Coindesk | COIN | -$2.68 | |

| Cronos Group | CRON | -$0.07 | |

| Ebix | EBIX | $0.58 | |

| Emerson | EMR | $1.29 | |

| GlobalFoundries | GFS | $0.45 | |

| Grocery Outlet | GO | $0.24 | |

| H & R Block | HRB | $1.24 | |

| Hilton Grand Vacations | HGV | $0.88 | |

| Hyatt Hotels | H | $0.03 | |

| IAC/InterActiveCorp | IAC | -$2.35 | |

| iRobot | IRBT | -$1.55 | |

| Maxar Technologies | MAXR | $0.12 | |

| Norwegian Cruise Line | NCLH | -$0.83 | |

| Plug Power | PLUG | -$0.20 | |

| Rackspace Technology | RXT | $0.16 | |

| Ralph Lauren | RL | $1.71 | |

| Roblox | RBLX | -$0.26 | |

| Spirit Airlines | SAVE | -$0.46 | |

| Super Micro Computer | SMCI | $2.35 | |

| Sysco | SYY | $1.11 | |

| The Trade Desk | TTD | $0.20 | |

| TTEC Holdings | TTEC | $0.85 | |

| Unity Software | U | -$0.21 | |

| Warner Music Group | WMG | $0.20 | |

| World Wrestling Entertainment | WWE | $0.55 | |

| Wynn Resorts | WYNN | -$0.97 | |

| Wednesday, August 10 | AppLovin | APP | $0.50 |

| Coherent | COHR | $2.13 | |

| Coupang | CPNG | -$0.10 | |

| CyberArk Software | CYBR | $0.01 | |

| Dutch Bros | BROS | $0.07 | |

| Fox Corp. | FOXA | $0.77 | |

| Franco-Nevada | FNV | $0.98 | |

| Jack in the Box | JACK | $1.42 | |

| Manulife Financial | MFC | $0.76 | |

| Matterport | MTTR | -$0.14 | |

| Pan Am Silver | PAAS | $0.14 | |

| Red Robin Gourmet | RRGB | -$0.16 | |

| Sonos | SONO | $0.21 | |

| Traeger | COOK | $0.04 | |

| Wendy’s | WEN | $0.22 | |

| Wolverine World Wide | WWW | $0.65 | |

| Thursday, August 11 | AerCap | AER | $1.42 |

| Baidu | BIDU | $10.92 | |

| Brookfield Asset Management | BAM | $0.69 | |

| Canada Goose | GOOS | $2.98 | |

| Cardinal Health | CAH | $1.18 | |

| Dillard’s | DDS | $2.88 | |

| Flower Foods | FLO | $0.27 | |

| Illumina | ILMN | $0.64 | |

| LegalZoom | LZ | $0.02 | |

| Melco Resorts & Entertainment | MLCO | -$0.44 | |

| Nio | NIO | -$1.36 | |

| Poshmark | POSH | -$0.25 | |

| Rivian Automotive | RIVN | -$1.63 | |

| Ryan Specialty Group | RYAN | $0.35 | |

| Six Flags | SIX | $1.04 | |

| Solo Brands | SOLO | $0.28 | |

| Toast | TOST | -$0.12 | |

| Utz Brands | UTZ | $0.12 | |

| Warby Parker | WRBY | -$0.02 | |

| W&T Offshore | WTI | $0.37 | |

| Wheaton Precious Metals | WPM | $0.32 | |

| Friday, Aug. 12 | Broadridge Financial | BR | $2.65 |

| Honest Company | HNST | $-$0.09 | |

| Spectrum Brands | SPB | $1.42 |

FDA Calendar

None

Past Week What’s Hot… and What’s Not

Top 12 High Short Interest Stocks

| Ticker | Company | Exchange | ShortInt | Float | Shares O/S | Industry |

| BBBY | Bed Bath & Beyond Inc. | Nasdaq | 46.38% | 61.57M | 79.96M | Retail (Specialty Non-Apparel) |

| ICPT | Intercept Pharmaceuticals Inc | Nasdaq | 43.76% | 23.62M | 29.71M | Biotechnology & Medical Research |

| MSTR | MicroStrategy Inc | Nasdaq | 39.29% | 9.32M | 9.33M | Software & Programming |

| BYND | Beyond Meat Inc | Nasdaq | 37.91% | 56.79M | 63.54M | Food Processing |

| SWTX | SpringWorks Therapeutics Inc | Nasdaq | 37.51% | 31.64M | 49.41M | Biotechnology & Medical Research |

| BIG | Big Lots, Inc. | NYSE | 37.37% | 26.49M | 28.92M | Retailers – Discount Stores |

| EVGO | Evgo Inc | Nasdaq | 35.65% | 67.76M | 69.00M | Utilities – Electric |

| UPST | Upstart Holdings Inc | Nasdaq | 35.60% | 72.32M | 84.77M | Consumer Lending |

| BGFV | Big 5 Sporting Goods Corp | Nasdaq | 34.65% | 20.85M | 22.33M | Retailers – Miscellaneous Specialty |

| SRG | Seritage Growth Properties | NYSE | 34.38% | 23.58M | 43.68M | Real Estate Operations |

| NKLA | Nikola Corporation | Nasdaq | 32.77% | 265.95M | 421.14M | Auto & Truck Manufacturers |

| BLNK | Blink Charging Co | Nasdaq | 32.54% | 33.98M | 50.20M | Utilities – Electric |

Tags: stock market preview, stock market preview August 8, 2022.