TDR’s U.S. Stock Market Preview For The Week Of July 11, 2022

A weekly stock market preview and the data that will impact the tape.

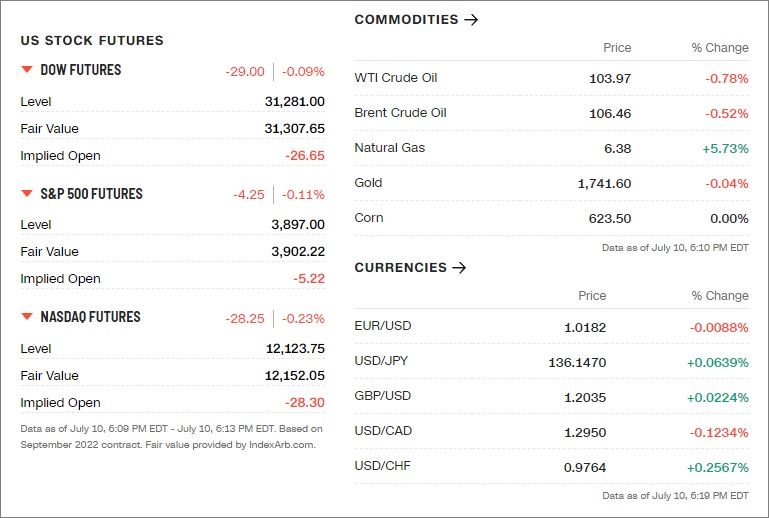

Sunday Evening Futures Open – Stock Market Preview

Weekend News And Developments

BlockSec, a blockchain security startup, announced the completion of the Seed Plus funding round with $8M raised. The funding round was co-led by Vitalbridge Capital and Matrix Partners, with participation from investors Mirana Ventures (Venture Partner of Bybit), CoinSummer, and YM Capital.

BlockFi Inc.: investors in the hobbled crypto lender that received a capital injection from digital-asset exchange FTX US, are prepared for some of their holdings to be wiped out.

Boeing (NYSE: BA) CEO Dave Calhoun recently hinted that his company could drop the longest version of the MAX jet from its product lineup. — Barron’s

Long Covid Is an elusive target for Big Pharma, according to the Wall Street Journal.

Macau will shut almost all business premises including casinos for a week from Monday as a Covid-19 outbreak in the gambling hub showed few signs of abating, Macao Daily reported.

MetaWorld Blockchain receives significant investment from billionaire Mai Vu Minh, who invested US$30 million in Meta world (METAD) developed in Switzerland.

Organigram Holdings Inc. (NASDAQ: OGI) (TSX: OGI), the parent company of Organigram Inc., a leading licensed producer of cannabis, will report earnings results for its third quarter 2022 ended May 31, 2022 on Thursday, July 14, 2022 before market open.

Rogers Communications (RCIb.TO) said July 9 that its services were close to fully operational after a massive outage it blamed on a router malfunction after maintenance work.

Sanofi: Pivotal data demonstrate once-weekly efanesoctocog alfa provides superior bleed protection compared to prior factor prophylaxis.

Sri Lankan President Gotabaya Rajapaksa will step down next week, after angry protesters swarmed his official residence and offices.

Trulieve Cannabis Corp. (CSE: TRUL) (OTCQX: TCNNF) announced the opening of a new medical dispensary in Apopka, Florida. Located at 2121 W Orange Blossom Trail, the Apopka dispensary opens at 9am on Saturday, July 9, 2022,

Twitter (NASDAQ: TWTR) received a notice of purported termination from Tesla (NASDAQ: TSLA) CEO Elon Musk and the Twitter Board issued the following statement in response: “We are committed to closing the transaction on the price and terms agreed upon with Mr. Musk and plan to pursue legal action to enforce the merger agreement. We are confident we will prevail in the Delaware Court of Chancery.”

Twitter: Wedbush analysts Daniel Ives and John Katsingris called the termination of the deal “a disaster scenario for Twitter,” adding that they anticipate an “elongated court battle” between Twitter (NASDAQ: TWTR) and Musk. On Saturday morning, the analysts revised their 12-month target price for Twitter shares to $30, down from $43, and restated their Neutral rating.

U.S. Treasury Secretary Janet Yellen has canceled her visit to the Port of Yokohama during her travel to Japan next week, a Treasury Department official said on Saturday, out of deference after former Prime Minister Shinzo Abe was assassinated.

What The Analysts Are Saying…

“The explosive sort of growth year over year that we’ve seen with Prime Day, we may not see that any longer.” — Nathan Burrow, senior deals editor at Wirecutter, on why shoppers may be less enthusiastic this year’s annual Amazon Prime sale. (July 9, 2022)

“The jobs report suggests that inflation’s not that bad, but there are other numbers that suggest it is. I think the question, to me, is how determined is the Fed to bring down inflation in the, say, next 18 months, how patient is it willing to be to let it stretch out longer… I think it’s going to be very, very difficult to have a soft landing. So, I think if the Fed tries to bring inflation down as fast as they’re talking about, the odds of a recession, a significant recession, are high.” — Professor of Economics at Harvard University and former International Monetary Fund Chief Economist Ken Rogoff (July 7, 2022)

Unfortunately, the Fed really implicitly has an objective now of keeping financial assets down, and we’re just going to have a very hard time getting used to that. That’s one of the biggest things they can do right now to move the dial on inflation… There will be a day when I am very positive about the stock market, but that day is not today.” — Phillip Toews, CEO at Toews Corporation, following Friday’s Nonfarm payrolls report.

👀What We’re Watching👀

• An update on Revive Therapeutics Ltd. (CNSX: RVV) (OTCMKTS: RVVTF) quest for endpoint change in their Phase 3 clinical trial to evaluate the safety and efficacy of Bucillamine to treat COVID-19 is coming close to a result. Exact timelines are unclear, however, we anticipate an update on their progress in a week or two. The FDA recently approved the company’s Data Access Plan (DAP) to allow for the unblinding of the pre-dose selection data to a designated company statistician.

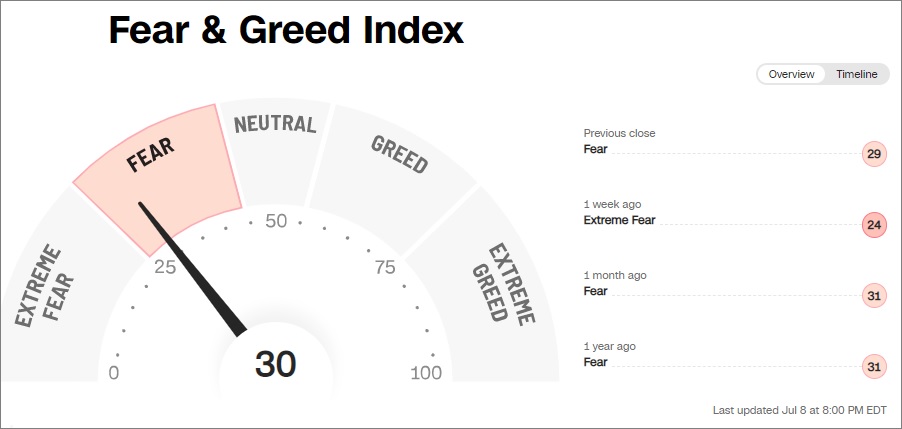

• Results of Wednesday’s Consumer Price Index (CPI) number—median estimate, 8.8% YoY—if above the consensus expectation, will go a long way towards cementing a 75-basis point rate hike at the Fed July 27 meeting. Currently, traders see an 88% chance of a 75-bps rate hike in July, 50-bps rate hikes fully discounted in September, and 25-bps rate hikes at the November and December meetings.

• Trade Idea 💡 — Myers Industries (NYSE: MYE) Is flashing short term sell (short) signal on our proprietary trading signals platform at prices within the $22.36-23.72 zone. Myers industries closed at $22.20 per share on Friday. First target @ the recent low of $21.19. TDR and/or author does not have a position in the aforementioned trade idea.

U.S. Economic Calendar

| Time(ET) | Report | Period | Median Forecast | Previous |

| Monday, July 11 | ||||

| 11:00 AM | 3-year inflation expectations | June | — | 3.90% |

| 2:00 PM | New York Fed President John Williams discusses move away from LIBOR | |||

| Tuesday, July 12 | ||||

| 6:00 AM | NFIB small-business index | June | 93 | 93.1 |

| 12:30 PM | Richmond Fed President Tom Barkin speaks | |||

| Wednesday, July 13 | ||||

| 8:30 AM | Consumer price index (monthly) | June | 1.10% | 1.00% |

| 8:30 AM | Core CPI (monthly) | June | 0.50% | 0.60% |

| 8:30 AM | CPI (year-over-year) | June | 8.80% | 8.60% |

| 8:30 AM | Core CPI (year-over-year) | June | 5.70% | 6.00% |

| 2:00 PM | Beige book | |||

| 2:00 PM | Federal budget (comparison vs. year-ago) | June | — | -$174 billion |

| Thursday, July 14 | ||||

| 8:30 AM | Producer price index final demand (monthly) | June | 0.80% | 0.80% |

| 8:30 AM | Initial jobless claims | July 9 | 234,000 | 235,000 |

| 8:30 AM | Continuing jobless claims | July 2 | — | 1.38 million |

| 11:00 AM | Fed Gov. Chris Waller speaks | |||

| Friday, July 15 | ||||

| 8:30 AM | Retail sales | June | 0.90% | -0.30% |

| 8:30 AM | Retail sales excluding vehicles | June | 0.50% | 0.50% |

| 8:30 AM | Import price index | June | 0.70% | 0.60% |

| 8:30 AM | Empire state manufacturing index | July | -1 | -1.2 |

| 8:45 AM | Atlanta Fed President Raphael Bostic speaks | |||

| 9:15 AM | Industrial production index | June | 0.10% | 0.10% |

| 9:15 AM | Capacity utilization | June | 80.50% | 80.80% |

| 10:00 AM | UMich consumer sentiment index (preliminary) | July | 50.2 | 50 |

| 10:00 AM | UMich 5-year inflation expectations (preliminary) | July | — | 3.10% |

| 10:00 AM | Business inventories | May | 1.20% | 1.20% |

😎Meme Of The Week😎

Key Upcoming Earnings (US Markets)

| Date | Symbol | Company | Earnings Call Time | EPS Estimate |

| Monday, July 11 | AZZ | AZZ Inc | Before Market Open | 1.03 |

| AFIB | Acutus Medical Inc | Time Not Supplied | -0.8 | |

| KLDO | Kaleido Biosciences Inc | Before Market Open | -0.51 | |

| GBX | Greenbrier Companies Inc | Before Market Open | 0.59 | |

| LMAT | LeMaitre Vascular Inc | Time Not Supplied | 0.25 | |

| OGI | OrganiGram Holdings Inc | Before Market Open | -0.02 | |

| PSMT | PriceSmart Inc | After Market Close | 0.8 | |

| VOXX | VOXX International Corp | After Market Close | 0.11 | |

| WAFD | Washington Federal Inc | Time Not Supplied | 0.77 | |

| Tuesday, July 12 | ANGO | AngioDynamics Inc | Before Market Open | 0.01 |

| ARTL | Artelo Biosciences Inc | Before Market Open | -0.05 | |

| PARR | Par Pacific Holdings Inc | Before Market Open | 1.74 | |

| PEP | PepsiCo Inc | Before Market Open | 1.74 | |

| UNTY | Unity Bancorp Inc | Before Market Open | 0.86 | |

| Wednesday, July 13 | BANF | BancFirst Corp | Time Not Supplied | 1.09 |

| DAL | Delta Air Lines Inc | Before Market Open | 1.64 | |

| FAST | Fastenal Co | TAS | 0.5 | |

| NKSH | National Bankshares Inc | After Market Close | 0.8 | |

| PTSI | PAM Transportation Services Inc | After Market Close | 1.15 | |

| WAL | Western Alliance Bancorp | Time Not Supplied | 2.33 | |

| Thursday, July 14 | CAG | Conagra Brands Inc | Before Market Open | 0.63 |

| CTAS | Cintas Corp | Before Market Open | 2.67 | |

| FRC | First Republic Bank | Before Market Open | 2.09 | |

| JPM | JPMorgan Chase & Co | Before Market Open | 2.94 | |

| MBCN | Middlefield Banc Corp | Before Market Open | 0.65 | |

| MS | Morgan Stanley | Before Market Open | 1.59 | |

| SCHW | Charles Schwab Corp | Before Market Open | 0.92 | |

| THTX | Theratechnologies Inc | Before Market Open | -0.09 | |

| Friday, July 15 | BK | Bank of New York Mellon Corp | Before Market Open | 1.14 |

| BLK | BlackRock Inc | Before Market Open | 8.54 | |

| C | Citigroup Inc | Before Market Open | 1.67 | |

| HNI | HNI Corp | Before Market Open | 0.34 | |

| PNC | PNC Financial Services Group Inc | Before Market Open | 3.14 | |

| STT | State Street Corp | Before Market Open | 1.85 | |

| UNH | UnitedHealth Group Inc | Before Market Open | 5.2 | |

| USB | US Bancorp | Before Market Open | 1.08 | |

| WFC | Wells Fargo & Co | Before Market Open | 0.86 |

FDA Calendar

BeiGene, Ltd. (NASDAQ: BGNE) Tuesday, 2022-07-12 In the U.S., a Biologics License Application for tislelizumab as a treatment for patients with unresectable recurrent locally advanced or metastatic ESCC after prior systemic therapy is currently under review by the U.S. Food and Drug Administration with a PDUFA target action date of July 12, 2022.

Bristol Myers Squibb (NYSE: BMY) Wednesday, Jul 13, 2022-07-13 The FDA granted the application Priority Review status and assigned a Prescription Drug User Fee Act (PDUFA) goal date of July 13, 2022.

Alnylam Pharmaceuticals, Inc. (NASDAQ: ALNY) Thursday, Jul 14, 2022-07-14 The updated Prescription Drug User Fee Act action date to allow for this review is July 14, 2022.

___________

__________

Past Week What’s Hot… and What’s Not

Short Interest Gainers

- Zymeworks (ZYME) estimated short interest was up six percentage points to 28.1% – the highest level on record – days to cover ratio increased from 0.2 to 2022-high 2.3. Stock has turned more volatile since the company received and subsequently rejected an all-cash offer from All Blue Falcons. +17.32% on the week

- Carvana (CVNA) volatility may be subsiding following a collapse in shares this past April, and the stock is looking to find some footing while following the higher-beta growth names higher. Estimated short interest on Carvana continues to trend higher rising another five percentage points this week to 41.4%, the highest level since late 2020 Wedbush noted this week on liquidity concerns having haunted the stock in Q2. While the analyst continues to see downside risk stemming from margin pressure, he also contends that these worries are overblown. +14.72% on the week

- Redbox (RDBX) retail-inspired short squeeze had fizzed since the stock’s peak in mid-June as trading volume in shares normalized. Ortex data suggest however that the bearish appetite for Redbox shares remains large, with estimated short interest rising from 136% to 156% this week. +1.80 on the week

- Bed Bath and Beyond (BBBY) estimated short interest increased for a fifth consecutive week, gaining another 4.9% points to reach 40.3% – the highest level since early 2021. The company’s recent Q1 results last week were weak, but the stock found some support amid insider buying from its newly appointed CEO Sue Gove. +8.06% on the week

(curated from commentary at thefly.com)

Tags: stock market preview, stock market preview July 11, 2022.