Analysts Throwing-In The Towel on MSOS in 2022—Is Now A Good Time To Buy?

After eleven months of constant decline, the analysts of starting to sour on the prospects of AdvisorShares Pure U.S. Cannabis ETF (NYSE: MSOS) and component stocks recovery in 2022. The latest evidence comes courtesy of Cantor Fitzgerald lead cannabis analyst (and Managing Partner), Pablo Zuanic, who believes it could be a lost year on the capital markets side. With analysts turning neutral/bearish after such large cyclical declines, is now the time to start buying MSOS? We explore further.

In a note released this morning, Pablo Zuanic pulled no punches on the state of the market by warning U.S. cannabis investments could be “dead-money” in calendar year 2022. The reason: rightly or wrongly, “Federal reform outlook is the main driver of group sentiment, as opposed to fundamentals.” Obviously, investors appear to be focusing on the latter despite countrywide sales trends that are generally moving in the right direction—aside from semi-mature and mature markets that have little bearing on MSOS growth.

In a partial response to the note—along with continued bearish market conditions that is ravaging the broad market—MSOS is getting hit hard. As of 12:45pm, MSOS has declined ↓7.33% percent, with bellweathers such as Curaleaf Holdings (↓7.61%) and Trulieve Cannabis (↓7.02%) bearing some of the greatest selling brunt.

From our perspective, the question is whether the analysts are late to the party here. After backing U.S. cannabis during most of the sector’s run up and subsequent decline in 2021, the analyst knives are coming out. And we think there is a lot of validity to the notion of slowing growth, with wholesale cannabis prices declining and inflation running at a torrid pace. In fairness, Pablo was one of the early analysts to point these dynamics out.

But with the market being a forward-looking discount mechanism, the question becomes: How much of the incredible multi-quarter decline in MSOS (and related components) is priced-in? Especially with valuations reaching rock-bottom levels in the sector?

While that’s an impossible question to answer, it is worth noting that cannabis is widely considered a consumer staple, meaning that consumer demand is relatively inelastic. In other words, demand will remain constant even if the economy falters as the year progresses.

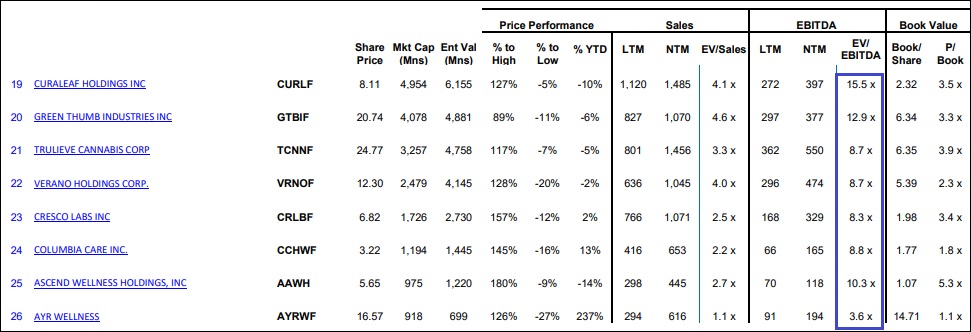

In relation to consumer sales in general, the above chart indicated just how discounted cannabis MSOS are. According to Siblis Research, the average enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) for much slower-growing Fortune 500 companies was 17.53 as of 12/31/2021. Granted, they don’t have punitive measure like IRS Tax Code 280e to deal with, but we think it typifies just how discounted MSOS and related components are—even if the fundamentals are completely out of vogue.

So while the broad market storm is upon us, long-term focused investors with capital to spare may view the current climate in a favorable light. Often, when the analyst knives come out, they are viewing the market from a current or backwards looking lens, while the market looks forward. A trying time for sure, but one offering tantalizing value for investors with long term time horizons.