Jushi Holdings Inc. Reports Second Quarter 2021 Financial Results

Second Quarter 2021 Revenue Increases 14.6% to $47.7 million as Compared to the First Quarter 2021

Net Income of $4.8 million, a $31.6 million Improvement as Compared to the First Quarter 2021

Reports Adjusted EBITDA(A) of $4.6 million

Updates Full Year 2021 Guidance and Initiates Full Year 2022 Guidance

Jushi Holdings Inc. (CNSX:JUSH) (OTCMKTS:JUSHF), a vertically integrated, multi-state cannabis operator, announced its financial results for the second quarter 2021 (“Q2 2021”) ended June 30, 2021 financial results. All financial information is provided in U.S. dollars unless otherwise indicated.

Second Quarter 2021 Highlights

- Total revenue of $47.7 million, an increase of 14.6% sequentially and 219.7% year-over-year

- Gross profit of $21.9 million, an increase of 9.2% sequentially and 193.7% year-over-year

- Net income of $4.8 million, a $31.6 million sequential improvement, was primarily driven by an increase in revenue, gross profit and a gain on fair value derivative liabilities.

- Adjusted EBITDA(A) of $4.6 million, or 9.6% of revenue

- $126.8 million of cash and short-term investments in securities on the balance sheet as of June 30, 2021

See “Reconciliation of Non-IFRS Financial Measures” at the end of this press release for more information regarding the Company’s use of non-IFRS financial measures.

Second Quarter 2021 Operational Highlights

- Opened its 19th and 20th BEYOND/HELLOTM retail locations nationwide with its 12th and 13th store in Pennsylvania

- Completed the acquisition of 100% of the equity of Organic Solutions of the Desert, LLC, an operational retail dispensary in Palm Springs, California

- Completed the acquisition of the 93,000 sq. ft. facility and surrounding nine acres of land operated by its wholly-owned subsidiary and Virginia based pharmaceutical processor, Dalitso LLC

- Signed a definitive agreement to acquire Nature’s Remedy of Massachusetts, Inc., a vertically integrated, single-state operator in Massachusetts, operating two retail dispensaries and a 50,000 sq. ft. cultivation and production facility

- Announced the appointment of Leonardo Garcia-Berg as Chief Operations Officer

- Announced the appointment of Marina Hahn to the Board of Directors

- Commenced the first phase of the expansion project at the Pennsylvania grower-processor facility

- Completed the previously announced acquisition of an established Nevada operator

Recent Developments

- Announced that Jushi’s partner, Northern Cardinal Ventures, LLC, was awarded a conditional retail dispensary license in Illinois via the state’s lottery process

- Plan to open the 21st BEYOND/HELLOTM retail location nationally and 14th store in Pennsylvania on August 31, 2021

- Completed the acquisition of a licensed cultivator in Ohio

- Debuted a series of cannabis brands and product launches in Virginia and Ohio

- Announced that the Company’s founders had converted super and multiple voting shares into subordinate voting shares

- Announced the appointment of Brendon Lynch as Executive Vice President of Retail Operations

- Received a ~$14.4 million interim arbitration award plus legal fees and accumulated interest

- Announced the transition to domestic issuer status in the United States

- Announced the expiration of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (“the HSR Act”) waiting period for the proposed acquisition of Nature’s Remedy of Massachusetts, Inc.

Management Commentary

I’m very pleased with our performance in the second quarter; we achieved strong sequential revenue growth, industry leading year-over-year revenue growth, and maintained Adjusted EBITDA profitability, while continuing to invest in our strategic growth initiatives. With our strong balance sheet we are well positioned to execute on our plans, which includes expanding our national retail footprint as well as building out our cultivation and processing assets to support increased demand from both patients and consumers for our high-quality products.

Jim Cacioppo, Chief Executive Officer, Chairman and Founder of Jushi

Mr. Cacioppo continued, “Our performance has been driven by our commitment to delivering a differentiated customer shopping experience both in-store and online, by bringing to market innovative and exciting new brands and products, and by leveraging cutting edge technologies and data analytics to improve customer engagement. As we look out to the second half the of the year, we plan on building on our recent successes and driving continuous improvement across all of our operating assets.”

Financial Results for the Second Quarter Ended June 30, 2021

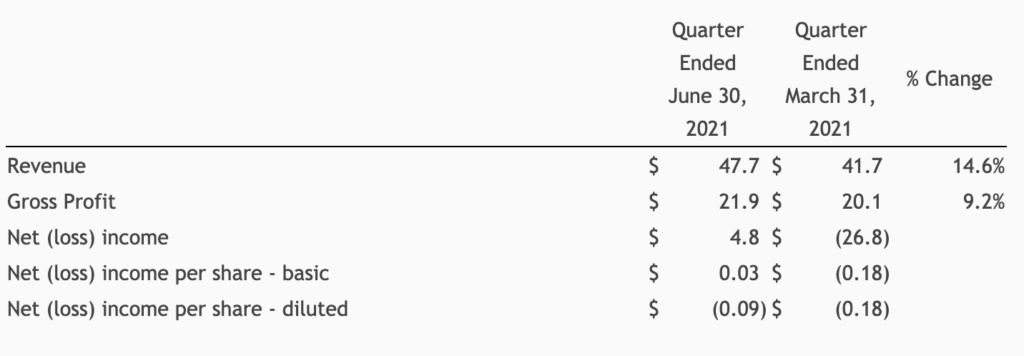

The following is a tabular summary and commentary of revenue, gross profit, net income (loss) and net income (loss) per share for the three-month periods ended June 30, 2021 and March 31, 2021.

($ in millions, except per share amounts)

Revenue in Q2 2021 increased 14.6% to $47.7 million, compared to $41.7 million in the first quarter of 2021 (“Q1 2021”). The 14.6% increase in revenue was driven primarily by solid revenue growth at the Company’s BEYOND/HELLOTM stores in Pennsylvania, Illinois, California and Virginia, and increased operating activity at its grower-processor facilities in Pennsylvania and Nevada.

Gross profit in Q2 2021 increased 9.2% to $21.9 million, compared to $20.1 million in Q1 2021. The increase in gross profit was primarily driven by the increase in revenue, partially offset by a decrease in net overall margins primarily driven by an increase in promotional activity.

Q2 2021 net income was $4.8 million, or $0.03 per basic share and net loss of $(0.09) per diluted share, compared to a net loss of $(26.8) million, or $(0.18) per diluted share in Q1 2021. The net loss of $(0.09) per diluted share in Q2 2021 was primarily due to the dilutive effects of the derivative warrants as accounted for under IFRS. The fair value gain on the derivative warrants is removed from basic earnings to calculate diluted net loss, which is then divided by the diluted weighted average number of shares. The $31.6 million improvement in net income in the second quarter was primarily driven by the gain on fair value derivative liabilities of $21.1 million.

Adjusted EBITDA(A) in Q2 2021 was $4.6 million, compared to Adjusted EBITDA(A) $4.5 million in Q1 2021, as updated for current period presentation. The increase in Adjusted EBITDA(A) on a sequential quarterly basis was driven by higher revenues and gross profit.

Balance Sheet and Liquidity

As of June 30, 2021, the Company had $126.8 million of cash and short-term investments. Total current assets of $164.3 million and current liabilities of $60.2 million as of June 30, 2021. Net working capital at the end of June 30, 2021 was $104.1 million. The Company incurred approximately $32.8 million in capital expenditures during Q2 2021 and $41.5 million year to date. The Company expects to incur an additional $65 million – $85 million in capital expenditures for the remainder of the year, subject to market conditions and regulatory changes, of which a portion will be funded by an existing sale-lease-back facility. As of June 30, 2021, the Company had $85.1 million principal amount of total debt, excluding leases and property, plant and equipment financing obligations.

Outlook

Mr. Cacioppo commented, “Looking ahead to the remainder of the year, we expect to open an additional seven BEYOND/HELLOTM dispensaries, add two dispensaries and a grower-processor facility in Massachusetts through the acquisition of Nature’s Remedy of Massachusetts and continue to build-out our Pennsylvania and Virginia grower-processor facilities, which will fuel our business as we head into 2022.”

Mr. Cacioppo added, “Assuming our Massachusetts acquisition closes late in the third quarter, we are revising our full year 2021 revenue guidance range from $205 to $255 million to $220 to $230 million and our 2021 Adjusted EBITDA guidance range from approximately $40 to $50 million to $32 to $37 million. The reduction in Adjusted EBITDA guidance relates to (1) the Virginia market developing slower than we initially forecast, mostly due to flower launching in September versus our assumption in July, the Company pivoting to a larger store format and the timing and regulations associated with the adult use program, which resulted in new store openings being delayed; (2) reducing the flower room capacity at the existing 89,000 square foot Pennsylvania grower-processor facility to accommodate post-harvest expansion related to expanding to a much larger facility than initially anticipated at acquisition in the summer of 2020; and (3) growth in corporate overhead that reflects the opportunity and challenges of the very significant growth associated with the larger than planned grower-processor expansion and the upcoming adult use markets in VA and PA, both of which may happen by 2023.”

Mr. Cacioppo concluded, “In addition, we are initiating our full year 2022 guidance. For full year 2022, we expect revenues to be between $375 to $425 million and Adjusted EBITDA to be between $110 to $130 million on an IFRS basis. We have built a robust, rapidly growing footprint in some of the most exciting markets in our industry and are well positioned to execute on our growth strategy to continue to drive long-term shareholder value.”

The Company’s MD&A and consolidated financial statements for the second quarter ended June 30, 2021, along with all previous public filings of the Company, may be found on SEDAR at www.SEDAR.com.

Conference Call and Webcast Information

The Company will host a conference call to discuss its financial results for the second quarter 2021 at 9:00 a.m. ET today, Wednesday, August 25, 2021.

| Event: | Second Quarter 2021 Financial Results Conference Call |

| Date: | Wednesday, August 25, 2021 |

| Time: | 9:00 a.m. Eastern Time |

| Live Call: | +1-877-407-0792 (U.S. Toll-Free) or +1-201-689-8263 (International) |

| Webcast: | http://public.viavid.com/index.php?id=145936 |

For interested individuals unable to join the conference call, a dial-in replay of the call will be available until September 25, 2021 and can be accessed by dialing + 1-844-512-2921 (U.S. Toll Free) or + 1-412-317-6671 (International) and entering replay pin number: 13721887.

To view the original press release in its entirety click here