MariMed Inc. Earnings Outlook, Set For After Market On March 1, 2023

MariMed MRMD is set to give its latest quarterly earnings report on Wednesday, 2023-03-01. Here’s what investors need to know before the announcement. Analysts estimate that MariMed will report an earnings per share (EPS) of $0.00.

MariMed bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter. New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

The company report is scheduled to report fourth quarter 2022 financial results on March 1, 2023 after the markets close. Management will host a conference call the next day on March 2, 2023 at 8:00 a.m. EST to discuss the report.

Historical Earnings Performance

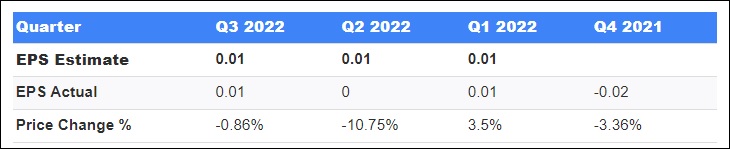

Last quarter the company missed EPS by $0.00, which was followed by a 0.86% drop in the share price the next day. Here’s a look at MariMed’s past performance of basic earnings per share, and the resulting price change:

Shares of MariMed were trading at $0.455 as of February 27. Over the last 52-week period, shares are down 42.89%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

As this is MariMed’s fiscal year end report, investors will also glean how important metric like revenue stack up against prior years. As the data below demonstrates, revenue growth has remained strong since the inception of the company, as it executes its growth footprint. Between 2020 and 2021, revenue 138.66%, although it won’t be close to that percentage gain this time around.

On a sequential basis based on third quarter 2022 financial results, the company posted a noble performance given the well-known consumer spending and pricing headwinds facing the industry. MariMed grew gross margin sequentially to 48% from 45%, GAAP net income improved to $2.7 million from $1.8 million, and Adj. EBITDA rose 46% when compared on a year-over-year basis.

All in an extremely tough market conditions where growth prospects were challenging.

Overall, it was the eleventh straight quarter of positive Adj. EBITDA for the company—a streak MariMed hopes to continue.

__________

This article was originally published on Benzinga and appears here with permission.

__________

* In accordance with an executed agreement between The Dales Report and MariMed, The Dales Report is engaged with the aforementioned on a 12-month contract for $7,500 per month, with the purpose of publicly disseminating information pertaining to MariMed via The Dales Report’s media assets, encompassing its website, diverse social media platforms, and YouTube channel. Compensation for The Dales Report services involves the receipt of a predefined monetary consideration, which may, on certain occasions, encompass ordinary shares in instances where monetary compensation was not obtained. In such instances where share compensation was received, The Dales Report hereby asserts the right to engage in the acquisition or disposition of such shares subsequent to the conclusion of the aforementioned contractual period, in compliance with provincial, state, and federal securities regulations. Please refer to the “Disclosures” section below, which is to be interpreted in conjunction with this disclaimer.