The Pelorus Fund Outperforms Benchmark Cannabis ETF By 8,458 Basis Points in 2022

While it was a catastrophic year for cannabis investors on the public market side, not all cannabs-focused funds suffered an apocalyptical fate. The Pelorus Fund, employing a mortgage REIT investment model that bypassed the extreme headwinds deeply suppressing public equity prices, churned out another strong yearly performance that came within a hair of meeting its target return.

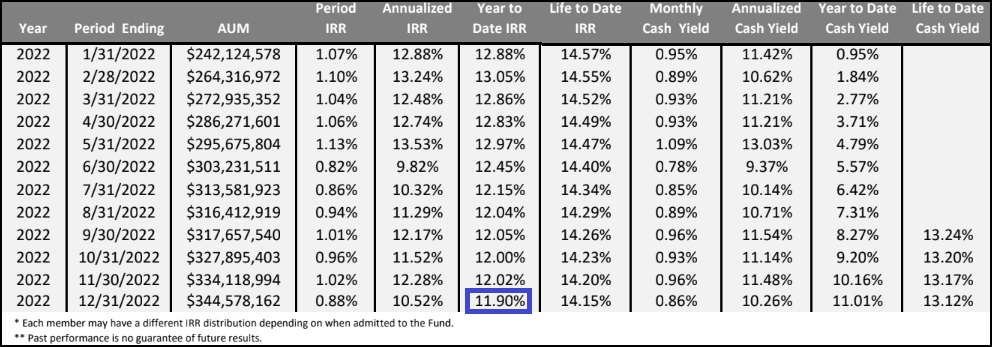

For 2022, The Pelorus Fund produced an internal rate of return of 11.90%, or about 10 basis points (Bps) below the low end of its target objective. Most strikingly, the performance was a full 8,458 Bps above the performance of the benchmark U.S. cannabis ETF, AdvisorShares Pure US Cannabis ETF (NYSE: MSOS), which declined 72.68%. Furthermore, the consistency of Pelorus Fund returns sharply contrasted to the wild gyrations seen on the exchanges owing to anticipated federal cannabis reform that never happened.

Zooming out a little further, we’ve calculated The Pelorus Fund has returned approximately 61% on aggregate to investors who have opted to receive monthly distributions since the Fund’s inception in June 2018 (four and one-half years).

For investors that have chosen to compound returns, that number jumps to over 80%. By reinvesting the interest earned off of the principle in the Fund, investors can increase the cumulative return over time. This is achieved by reinvesting interest along with the principle, so that interest in the next period is then earned on the principal sum plus previously accumulated interest.

While an apples-to-apples performance comparison to MSOS ETF cannot be made since the latter first began trading on September 2, 2020, MSOS has lost 73.93% since inception from the closing price following its much-ballyhooed IPO listing on the New York Stock Exchange.

Although The Pelorus Fund employs a mortgage REIT lending strategy in which senior secured notes are collateralized by cannabis-use real estate properties with personal and corporate guarantees from the sponsors, it does have exposure to the public markets. As part of negotiated ‘sweeteners’ in some of its deals, the Fund controls equity warrants on its book which may be exercised in favorable market climates. It is a virtually risk-free way to boost returns beyond the lending interest it receives on the mortgage debt.

Looking ahead in 2023, The Pelorus Equity Group is maintaining its long term target rate of between 12-15% returns for investors of its Fund. With assets under management (AUM) steadily rising over time, the company should have the ability to deploy steadily-increasing capital into new lending opportunities.

And with SAFE Banking shot down for a second consecutive year and lending conditions remaining neutral—or even slightly more restrictive from the chartered banks—we anticipate the competitive tailwinds for Pelorus’ mortgage REIT lending model will remain intact.

__________

* In accordance with an executed agreement between The Dales Report and Pelorus Capital Group, The Dales Report is engaged with the aforementioned on a 12-month contract for $7,500 per month, with the purpose of publicly disseminating information pertaining to Pelorus Capital Group via The Dales Report’s media assets, encompassing its website, diverse social media platforms, and YouTube channel. Compensation for The Dales Report services involves the receipt of a predefined monetary consideration, which may, on certain occasions, encompass ordinary shares in instances where monetary compensation was not obtained. In such instances where share compensation was received, The Dales Report hereby asserts the right to engage in the acquisition or disposition of such shares subsequent to the conclusion of the aforementioned contractual period, in compliance with provincial, state, and federal securities regulations. Please refer to the “Disclosures” section below, which is to be interpreted in conjunction with this disclaimer.