On our newest Trade to Black Podcast, we speak again with the Managing Partner of Pelorus Equity Group, Travis Goad. With cannabis stocks descending to new lows following the latest round of legislative disappointments on Capitol Hill, Travis lends new insight on a variety of issues regarding the cannabis market in 2023, and particulars on The Pelorus Fund, which is providing stable and consistent returns as equity markets languish.

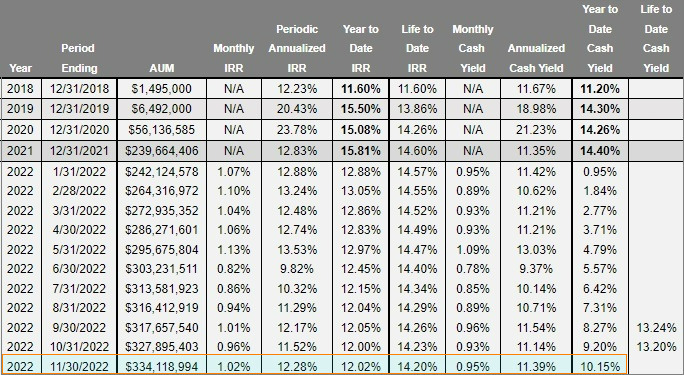

On the investment side of the equation, Mr. Goad talks about the benefits of compounding, which many investors in The Pelorus Fund opt to do. The Fund employs a mortgage REIT lending strategy in which senior secured notes are collateralized by cannabis-use real estate properties with personal and corporate guarantees from the sponsors, thus earning income from the interest paid on those assets.

By reinvesting the stable interest earned off of the principle in the Fund, investors can increase the cumulative return over time. This is achieved by reinvesting interest along with the principle, so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Investors are essentially earning ‘interest on interest’, which can boost returns above a ‘simple interest’ strategy (non-compounding method).

And since Pelorus Fund compounds distributions at a monthly rate, the ‘compound effect’ is accelerated over Funds that reinvest distributions on a quarterly or bi-annual basis.

Travis further reveals that returns can be further amplified through the exercise of warrants—structured in the lending deals of the firm.

Warrants are a derivative that give the right, but not the obligation, to buy or sell a security at a certain price before expiration. So when cannabis equity prices eventually find their footing and increase to a material degree, The Pelorus Fund may exercise ‘in the money’ equity warrants and distribute the proceeds by divesting equity with positive gains. The warrants provide a virtually risk-free way to obtain upside public market exposure without being tethered to the downside.

Click on the embedded link to view our latest interview with Managing Partner of Pelorus Equity Group, Travis Goad, in his own words.

__________

* In accordance with an executed agreement between The Dales Report and Pelorus Capital Group, The Dales Report is engaged with the aforementioned on a 12-month contract for $7,500 per month, with the purpose of publicly disseminating information pertaining to Pelorus Capital Group via The Dales Report’s media assets, encompassing its website, diverse social media platforms, and YouTube channel. Compensation for The Dales Report services involves the receipt of a predefined monetary consideration, which may, on certain occasions, encompass ordinary shares in instances where monetary compensation was not obtained. In such instances where share compensation was received, The Dales Report hereby asserts the right to engage in the acquisition or disposition of such shares subsequent to the conclusion of the aforementioned contractual period, in compliance with provincial, state, and federal securities regulations. Please refer to the “Disclosures” section below, which is to be interpreted in conjunction with this disclaimer.