Vext Science And C21 Investments Exhibit Strong Liquidity And Low Leverage Profile, According To VCA

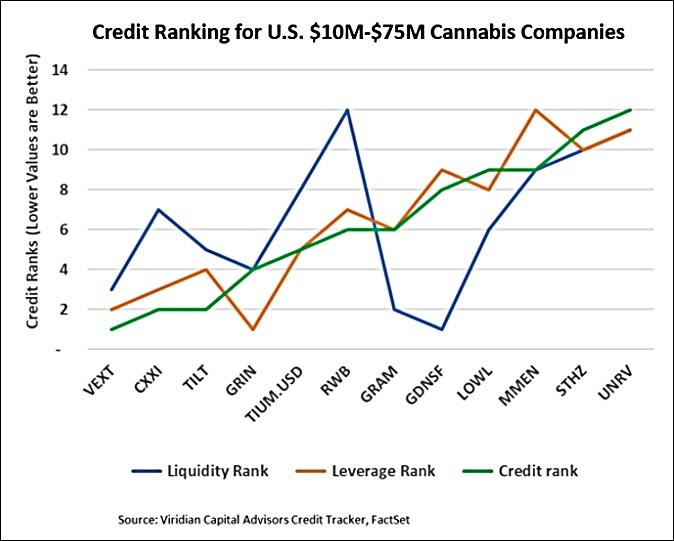

The graph depicts the two most significant factors in the Viridian Credit Tracker credit scoring model, Liquidity (blue) and Leverage (red) for the group of 12 U.S. Cultivation & Retail companies with market caps between $10M and $75M. On the face if it, Vext Science and C21 Investments liquidity and low leverage profiles show favorably on a comparative basis.

The Viridian model uses eleven financial and market-based ratios to measure these two factors and Profitability and Size to determine a credit score and credit ranking (green).

The companies on the left side of the graph, including Vext Science VEXTF and C21 Investments CXXIF exhibit strong liquidity and low leverage and earn top credit ranks.

Companies on the right side of the graph, including MedMen MMNFF, StateHouse STHZF, and Unrivaled Brands UNRV have both high leverage and low liquidity resulting in the worst credit rankings on the graph.

Credit quality is not static; aggressive liquidity management can sometimes successfully raise credit quality significantly, while in other cases, these restructuring moves fall short:

- Tilt Holdings had $76.5M of current maturities on its September balance sheet, causing a significant liquidity issue. Its free cash flow adjusted current ratio of .83 clearly shows the problem. Tilt substantially eliminated the liquidity squeeze by undertaking a $15M sale-leaseback, $38M of Amended and Restated notes due 2026, and $8.2M of PIK Secured Promissory Notes due 2027. Additionally, the company used cash from operations to retire approximately $10M of debt in Q4: 2022 and Q1: 2023. The net result is a dramatic improvement in liquidity ranking from #7 to #5 and overall credit ranking to #3.

- In our view, Red White & Bloom’s restructuring program was less successful in curing its credit stresses. RWB’s June balance sheet virtually screamed “liquidity crises,” with FCF adjusted current ratio of .09. Like Tilt, RWB substantially restructured its liability structure, doing approximately $10.5M of debt for equity swaps and refinancing roughly $70M of maturities to 2024. Unfortunately, these moves were insufficient to solve its liquidity issues, and the company continues to rank the lowest of the group on this measure.

Pursuing active liability management to its best effect requires closely examining a company’s key credit weaknesses and focusing on that problem.

The Viridian Capital Chart of the week highlights key investment, valuation and M&A trends taken from the Viridian Cannabis Deal Tracker. It provides the market intelligence that cannabis companies, investors, and acquirers utilize to make informed decisions regarding capital allocation and M&A strategy.

Since its inception in 2015, the tracker has monitored capital raises and M&A activity in the legal cannabis, CBD, and psychedelics industries.

__________

This article was originally published on Benzinga and appears here with permission.