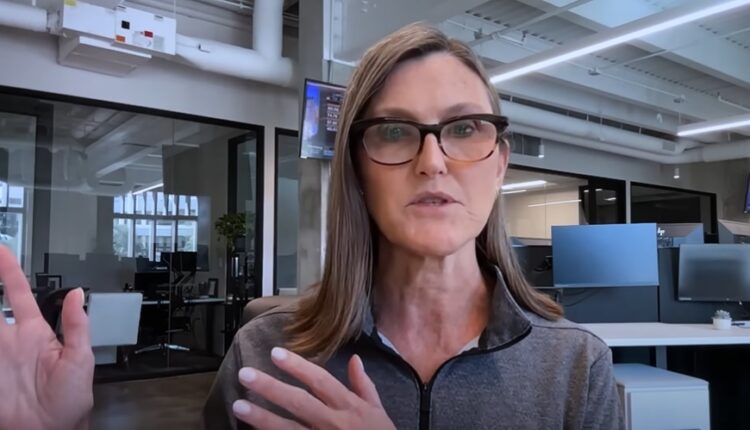

Cathie Wood Builds Up Stake In Coinbase Following FTX Collapse

Cathie Wood led ARK Investment Management on Tuesday sold over a million shares of Robinhood Markets Inc. HOOD-5.84% at an estimated valuation of over $9 million. Shares of the brokerage platform closed over 19% lower on Tuesday over the FTX saga.

Cryptocurrency exchange Binance signed a non-binding agreement on Tuesday to buy FTX’s non-U.S. unit to help tide over a liquidity crunch at the rival exchange. Volatility in crypto and crypto-related stocks had ensued earlier when Changpeng Zhao, the founder and CEO of Binance announced his trading platform is about to liquidate its entire FTT FTT/USD holdings.

Wood’s funds also bought over 420,000 shares of cryptocurrency exchange platform Coinbase Global Inc. COIN-5.45% at an estimated valuation of over $21 million. The purchase was done via three of the company’s ETF.

Coinbase is the 11th largest holding of ARK’s flagship fund – the ARK Innovation ETF. The company started in 2012 with the radical idea that anyone, anywhere, should be able to easily and securely send and receive Bitcoin. Today, it offers a trusted and easy-to-use platform for accessing the broader cryptoeconomy.

Coinbase recently added Primer to its payments platform, which works with merchants operating across multiple industries through the UK, Europe , US and APAC, to satisfy a growing appetite for crypto as a payment method.

ARKK with a weight of over 3.94%. Shares of Coinbase closed over 10% lower on Tuesday and shed 1.22% in extended trading after investors were worried about the financials of cryptocurrency exchange FTX.

Coinbase later wrote a blog to calm investors saying it does not have a liquidity problem and that it largely holds its assets in dollars. “We ended Q3 with $5.6 billion in total available $USD resources, including $5B in cash and cash equivalents,” it said.

__________

This article was originally published on Benzinga and appears here with permission.