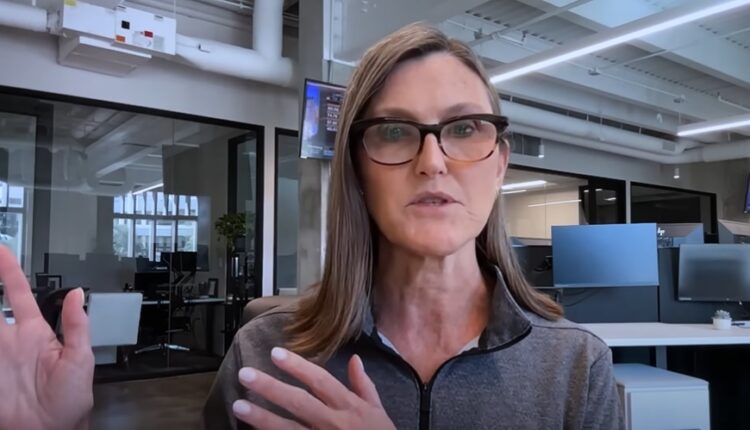

Cathie Wood Outlines Role Of Bitcoin Post ETF Approval

Signs that the U.S. Securities and Exchange Commission (SEC) will approve a Spot Bitcoin exchange-traded fund (ETF) in January are “very encouraging.”

That’s according to Ark Invest CEO Cathie Wood, who is collaborating with 21Shares on two futures ETF products centered on Ethereum ETH/USD and Bitcoin BTC/USD.

In a Tuesday interview with CNBC’s Crypto World, Wood expressed that the SEC’s “depth of knowledge” and understanding of the issues has changed for the better and there will likely be approval by Jan. 10, 2024.

“We’re watching the plumbing and the plumbing works,” Wood said, praising 21Shares as “the largest pure-play ETP crypto provider in the world with roughly $2 billion in assets.”

A spot Bitcoin ETF will stimulate once institutions and other investors have a toe hold into the space. “They will want ways to diversify, and we wanted to be ready to actively manage diversification strategies,” she said.

Outlook 2024: Wood goes on to say that 2024 will continue the trend from 2023 when Bitcoin managed to post record 50% gains despite a regional bank crisis.

Unlike the banking system, the crypto tokens do not have any counterparty risk and are decentralized and transparent with investors allowed to track token movements, and unusual activities on-chain.

She also adds that Bitcoin is a hedge against inflation and deflation. Within five years, Bitcoin will be treated like an investment in physical gold, she says.

There may even be a time when Bitcoin will be used as a legal tender in more emerging economies. El Salvador has already voiced support for Bitcoin and crypto assets on that front.