Digital Asset Investment Products See Record Outflows Amid Banking Crisis

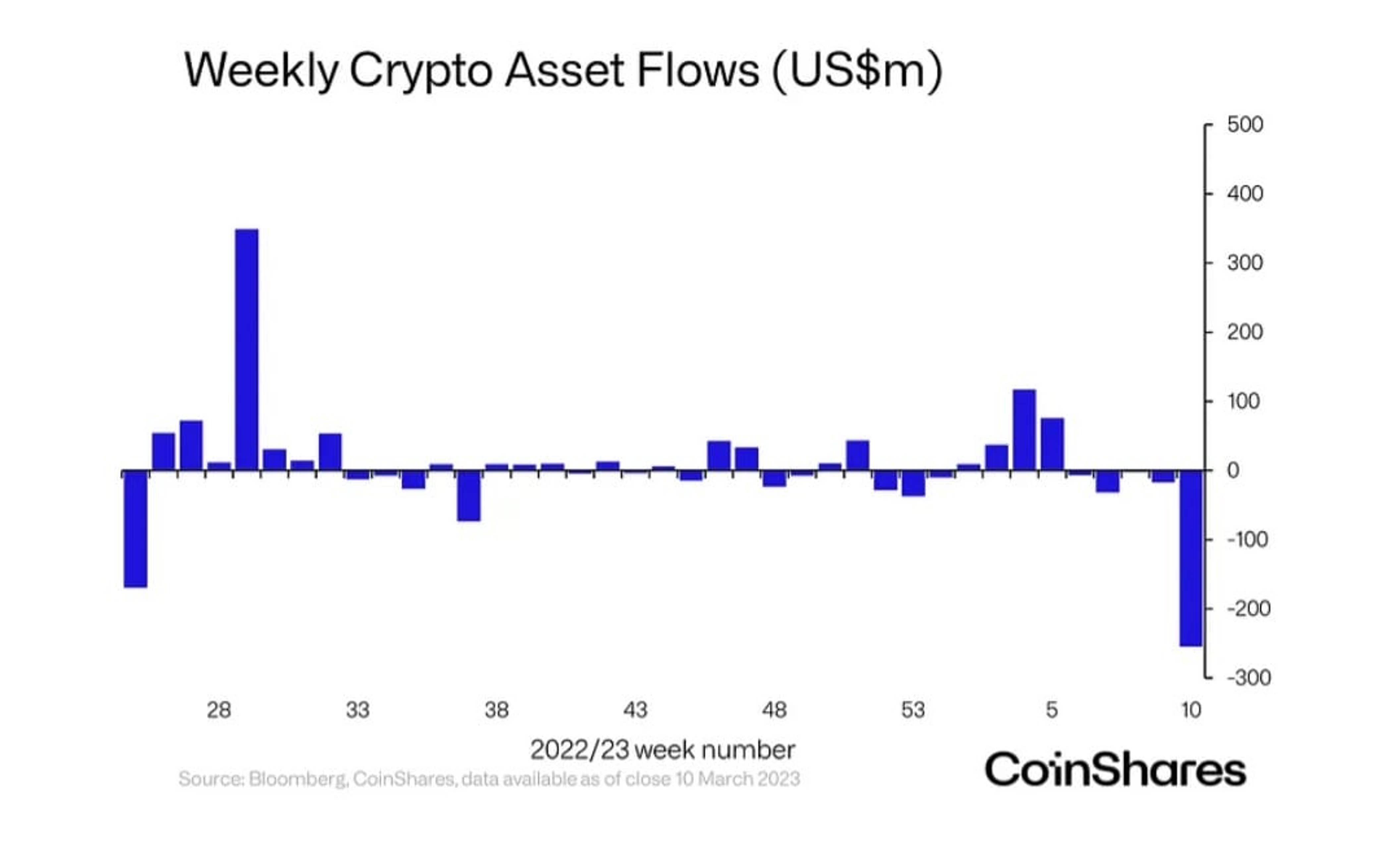

Digital asset investment products have seen outflows for the fifth consecutive week, with the total amount reaching a record high of $255 million, representing 1.0% of total assets under management (AuM).

According to a report by Coinshares, while the outflows are the largest on record in dollar terms, the percentage of outflows relative to total AuM was greater in May 2019, when outflows represented 1.9% of AuM.

The negative sentiment was broad, with negative sentiment seen in both North America and Europe.

However, the U.S. stood out with inflows of $11 million, primarily into long Bitcoin BTC/USD. Despite the increase in total AuM since May 2019 (816%), the outflows wiped out all the inflows seen this year, with outflows now standing at $82 million year-to-date.

Bitcoin, being the largest digital asset, was the primary focus, seeing outflows totalling $244 million last week.

Short bitcoin also saw outflows totalling $1.2 million.

Ethereum ETH/USD also saw outflows totalling $11 million last week, while its flows year-to-date have also turned negative, but to a much lesser extent of $3 million.

Other altcoins saw minor inflows, such as Solana SOL/USD with $0.4 million and Ripple XRP/USD with $0.3 million.

According to the report, this recent trend of outflows from digital asset investment products may reflect a growing concern among investors about the volatility of these assets.

It should be noted there are still many investors who remain bullish on the long-term prospects of digital assets, and this is reflected in the inflows seen in certain regions, such as the U.S.

__________

This article was originally published on Benzinga and appears here with permission.