TDR’s Diamond Hands Podcast #5: MSOS With Room To Run If Backdoor SAFE Amendment Makes NDAA Bill

In TDR’s Diamond Hands Podcast #5, we speak with Lead Financial Writer Benjamin A. Smith and AdvisorShares Portfolio Manager, Dan Ahrens. On the agenda: The thinking behind portfolio allocations and structure behind AdvisorShares new psychedelic exchange traded fund, PSIL. We also speak to Benjamin about the state of both the cannabis and psychedelic sectors, why AdvisorShares Pure US Cannabis ETF (MSOS) moved last week, and why momentum may continue should the SAFE Banking Act—attached as an amendment to the National Defense Authorization Act (NDAA) last week—makes the final Bill.

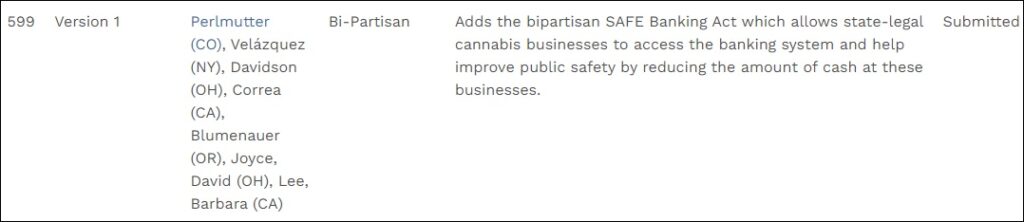

Of course, the latter was the primary reason why the downtrend in MSOS reversed course last week. House lawmakers introduced a series of drug policy-related amendments to defense legislation, which also included psychedelics for active duty military personnel. If SAFE Banking is adopted as an amendment to the NDAA, SAFE would pass sooner than almost everyone expected.

While everyone was looking at the front door at Senate Majority Leader Chuck Schumer’s more encompassing Cannabis Administration and Opportunity Act (CAOA) legislation, everyone took there eye off the back door—where non-related legislation often gets added to frontline Bills. We shall know early this week whether SAFE Banking makes the final cut.

Episode #5 CliffsNotes…

Psychedelics

@1:00-2:26 The psychedelics market is in need of a catalyst to get investors excited to buy into the industry.

@2:28-4:05 AdvisorShares new psychedelic ETF, (NYSEARCA: PSIL), has a good shot of becoming the industry benchmark ETF in the sector.

@4:18-5:30 How big can the psychedelics industry get? Dan Ahrens believes psychedelic could be where Canadian cannabis was circa 2018.

@5:35-8:10 Is it a good time to introduce PSIL ETF with equity values depressed at this point in time? Dan believes AdvisorShares PSIL is the most pure-play psychedelic ETF on U.S. exchanges today.

@8:10-10:57 Methodology behind the allocations in PSIL ETF. Direct equity investments in liquid, Big Exchange stocks; total return swaps for psychedelic listings on secondary exchanges.

@10:58-12:56 More issues coming, but selectivity is in store.

@12:57-14:53 Does a Portfolio Manager care more about the direction of price action or the fundamentals? Dan Ahrens is clear that the fundamentals of MSOS portfolio stock remain very strong.

Cannabis

@14:54-17:00 A summary about what the NDAA is and SAFE Banking legislation attachment to the Bill.

@17:01-18:16 No one foresaw the SAFE Banking Act getting attached as an amendment to the NDAA, which really had a big impact in trade last week.

@18:17-19:50 If SAFE makes the NDAA as an amendment, this has the potential to turn the tide in the sector. We think more upside is coming on a positive outcome.

For the weekly Diamond Hands Podcast stock picks, please tune in until the end.

To view Diamond Hands Podcast Episode #4, click here.