Public Gaming Companies Are Big Winners In Ontario’s Single Game Sports Betting Rollout

A bold new chapter in sports betting is coming to Ontario—Canada’s most populous province. On April 4. sports fans will be able to bet on single-game sporting events for the first time. Furthermore, the monopoly in multiple-game parlay style betting held by Proline—owned by the Ontario Lottery and Gaming Corporation—will give way to competition from several major sportsbooks—some with parent companies that are publicly traded. TDR reveals who the main players are and which public companies stand to benefit for Ontario single game sport betting, soon open for business on April 4.

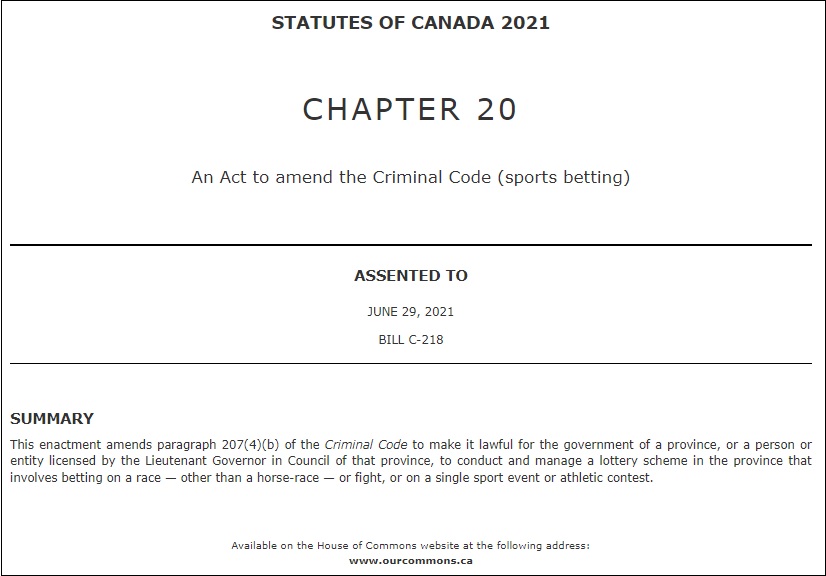

The genesis of single game sports betting in Ontario began in August 2021, when the federal government legalized single game wagering in Canada. Bill C-218 passed into law as the Safe & Regulated Sports Act and granted provinces and territories the power to regulate sports wagering as they saw fit. Plagued by massive budget deficits that are among the highest in the nation, sports betting measured eventually garnered provincial approval. It is expected single game sports betting will add a much-needed revenue infusion for the province, which has seen a substantial decline in casino gaming revenue during the COVD pandemic.

That enactment of Bill C-218 has lead to a rush of applications from foreign domiciled companies to enter the market. They are wooed by the aggregate size of the Ontario sports betting market, which at approximately 14.5 million, is roughly the size of Illinois and New Mexico combined. In fact, Ontario will become the second largest jurisdiction by populations for online sports betting in North America, behind only New York.

In August 2021, ProLine began accepting single game sports bets at brick & mortar and online locations across Ontario via the ProLine+ platform. Although it received de facto automatic approval, its long-held monopoly will vanish as the first Ontario online betting sites go live on April 4. Several household brands that have procured the requisite licenses will enter the mix, and this will create a robust ecosystem of sports betting options in Ontario.

So without further ado, here are the publicly-listed companies which have obtained licenses and stand to benefit as their wholly-operated sportsbook brands open up shop in Ontario on April 4.

DraftKings

DraftKings (NASDAQ: DKNG) is one of the most recognized sportsbooks in North America. According to their most recent financial results, the company reported revenue of $473 million in the fourth quarter of 2021—an increase of 47% compared to $322 million during the same period in 2020. In fact, fourth quarter revenue exceeded the guidance previously during its third quarter earnings conference by 8 percent.

Monthly Unique Payers in DraftKings B2C segment increased 32% compared year-over-year. On average, 2 million monthly unique paying customers engaged with DraftKings during each month in Q4 2021. The company will now have access to a pool of approximately 14.5 million Ontarioans in which to increase its client database.

Of note, DraftKings (as well as FanDuel) announced they will no longer offer free or paid daily fantasy contests in Ontario beginning April 1. Due to the new regulations, contests would be limited to contestants playing against other contestants inter-province. As well, high licensing fees and 20% revenue cut share to the province dissuaded DraftKings from continuing.

Penn National Gaming (theScore, Pointsbet)

Penn National Gaming (NASDAQ: PENN) stands as a material winner among public companies when single game sports betting goes live in Ontario on April 4. The company earned a whopping $1.6 billion in the Q4 2021 alone—an increase of $545.1 million year-over-year and $231.3 million versus 2019. This included a net income of $44.8 million and net income margin of 2.8%, so the company is profit net of regular business expenses and taxes.

The company boasts at least 24 million customers on its mychoice loyalty program, demonstrating the size and scale of its user base.

On October 19, 2021, Penn National Gaming completed its previously announced acquisition of Score Media and Gaming Inc. (theScore) for total consideration of approximately U.S.$2.0 billion in cash and stock. The transaction created one of North America’s leading digital sports content, gaming and technology providers which tied into Penn National existing sportsbook operations.

On Sept. 10, 2021, Penn National acquired a 6.27% stake in PointsBet Holdings Ltd (OTC:PBTHF), a leading Australian sports betting company that launched in the U.S. in 2019. Penn National converted options from 2019 that were set to expire on Sept. 12. Penn is now the top shareholder of PointsBet. PointsBet had revenue of $194.66 million and over 350,000 cash active clients in fiscal 2021, which ended June 30, 2021.

Flutter Entertainment (FanDuel Sportsbook)

U.K. based Flutter Entertainment (LSE: FLTR) revealed annual earnings recently that were affected by a run of “unprecedented” run of punter-friendly sports results. The group, which also owns the PokerStars and Sky Bet brands, posted a 24% decline in underlying pre-tax profits to £620 million for 2021, despite revenues rising 17% on a constant currency basis to £6 billion. On a bottom line basis, it swung to a £288 million loss from £1 million in profits in 2020.

For fiscal 2022, the 21-analyst revenue estimate stands at £6.8 billion which would represent 13.60% sales growth from 2021. The high 21-analyst estimate is £7.74 billion, while the low estimate is £6.14 billion.

BetMGM Sportsbook

BetMGM, LLC, which is jointly owned by MGM Resorts International (NYSE: MGM) and Entain Plc (LSE: ENT), is one of the leading sports betting and iGaming operators across the U.S. Performance in 2021 was five times greater than the previous year, with net gaming revenue improving to around $850m. Same state revenues were up around 140% year-over-year.

BetMGM, currently the number two operator for sports betting and igaming, held a Q4 market share of 23% across the markets in which it operates, and a 29% market share in igaming. BetMGM is now live in 21 markets, reaching over 37% of the US adult population, with launches in Illinois and Ontario coming on April 4.

Caesars Sportsbook

Caesars Entertainment (NASDAQ: CZR) is a massive entertainment conglomerate and one of the world’s most diversified casino-entertainment providers. In Q4 2021, Caesar’s reported GAAP net revenues of $2.6 billion versus $1.6 billion for the comparable prior-year period. For the full year, GAAP net revenues of $9.6 billion versus $3.6 billion for the comparable prior-year period.

In 2021, Caesar’s completed its acquisition of the renowned British sportsbook William Hill PLC and applied strong operating cash flows to debt reduction of approximately $1.0 billion. The company seeking to reduce debt in 2022 through the receipt of asset sale proceeds and cost savings measures from its maturing sportsbook operations.

Caesars Sportsbook is currently live in 22 states and jurisdictions, 16 of which offer mobile wagering.

Rush Street Interactive (Betrivers.com)

Rush Street Interactive (NYSE: RSI) recently announced Q4 2021 results which slightly missed the 9-analyst estimate on the topline. Revenue was $130.6 million, which represented an increase of 31% compared to $100.0 million during the fourth quarter of 2020. For full year 2021, revenue was $488.1 million during full year 2021—an increase of 75%, compared to $278.5 million during full year 2020.

Real-money Monthly Active Users, or MAUs, in the United States in Q4 2021 were up 28% year-over-year while average revenue per MAU of $327 during the fourth quarter of 2021. The company did not disclose total aggregate users of its sportsbook properties in its ecosystem.

Rivalry

On October 28, 2021, Rivalry Corp. (CVE: RVLY) submitted an application to the Alcohol and Gaming Commission of Ontario (AGCO) to operate in Toronto and the province of Ontario. Its registration was approved by the AGCO three month later and announced on February 4, 2022.

According to its latest financial results (Q3 2021), betting handle for the quarter was $23.2 million, up 141% from $9.6 million in Q3 2020. Revenue was $3.7 million in Q3 2021, an increase of $3.2 million from $0.5 million in Q3 2020. No numbers on total customers have been disclosed.