Three Simple Tips To Make Your Money Go Farther In 2023

Now that 2023 has arrived and the holiday bills lay in-wait, many North American consumers will be paying down credit card debt in the coming days. With this reality may come contemplation about how to make ends meet with personal finances in the year ahead, with inflation still hovering near multi-year highs. Unless you are one of the lucky few to see your paycheck outpace real inflation, most will have to do more with less in the coming year.

Although macroeconomic uncertainties abound, there are choices individuals can do to mitigate impact on one’s bank account. It just takes a little preparation, savvy and understanding that purchasing efficiency is now paramount. Less people than ever can afford wasteful spending in an era where credit is expensive relative to the intermediate past.

So with this in mind, below are five recommendations that can help you, the individual consumer, survive the discretionary pinch induced by higher interest rates and plunging real savings levels.

1. Use Credit Cards Judiciously

Credit cards are a useful spending medium, especially when one has the ability to pay off the balance in a timely fashion. But consumers can get into trouble if they allow the balance to linger, thereby allowing interest to compound at ever-higher levels. Maximum allowable interest rate levels vary by jurisdiction, but needless to say they are much higher than the Fed Funds Rate, currently set at 4.5%.

Since the spread between standard credit card rates and other forms of debt is wide, the former is not an ideal mechanism for purchasing. Thus, controlling levels of credit card debt relative to discretionary income is one of the best ways to control unproductive debt service payments from a one’s personal bank account.

If at all possible, consider using personal lines of credit from the bank, which often come at lower borrowing costs. As well, consider limiting credit card debt into payments that you know can be paid back in a short period of time—preferably within one month of purchase.

2. Refinance Consumer Loans

The biggest loans for more people is their mortgage payment. Typically, it can make sense to explore refinance options if it can reduce your current interest rate by 1% or more, depending on the remaining principle due on the mortgage. By reducing the payments, refinancing to a lower interest rate can allow you to build equity in your home more quickly. But it can also extend the timeline of the payment, so the devil is in the details. In a best case scenario, it may be possible to shorten the loan term if interest rates have dropped low enough without much changing the monthly payment.

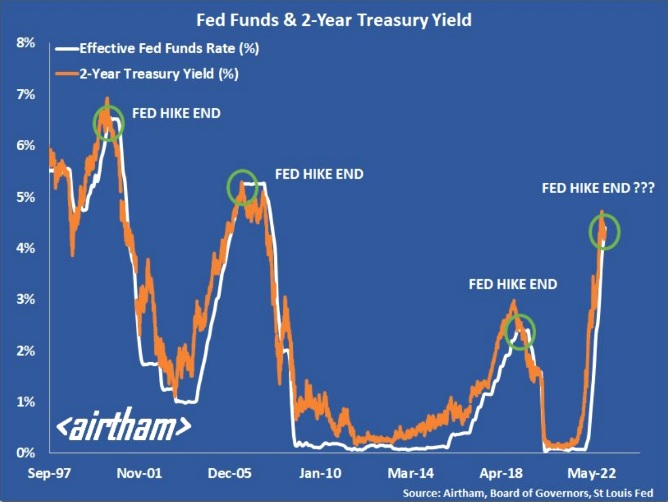

For the financially attuned, anticipating falling interest rates could be a reason to convert from fixed rate to a variable rate debt. If you locked into fixed rate debt over the second half of 2022 because you couldn’t chance the uncertainty of higher rates, many analysts are expecting the Fed Funds rate to plateau in 2023, and possibly reverse, which will positively lower lending rates along the curve. If the analysts are correct, swapping fixed with variable rates should have increasing benefits as 2023 progresses and economic conditions tighten.

3. Purchase Airline Tickets In Advance

As many people have come to realize, the cost of air travel and skyrocketed over the past couple of years. According to the U.S. Bureau of Labor Statistics, airfare rose 42.9% from September 2021 to September 2022 alone. While much of the increase was in lockstep with rising energy prices, additional tax levies have boosted tickets to levels well above the real inflation rate.

if you think government imposed taxes are too high, consider that up to 87% of the total cost of an airline ticket is made up of taxes and fees. This ranges from everything from airport improvement fees, arrival & departure Fees, international VAT taxes and everything in between.

While the individual has no choice but to absorb these surcharges in general, consumers can reduce costs through strategic planning. Consider purchasing tickets at least two months in advance where possible, when base ticket costs are lowest due to high vacancy levels. Additionally, one can achieve greater savings by traveling on weekdays, such as from Thursday to Tuesday, and avoiding flying on peak demand dates such as March Break and observed holiday seasons.