Analyst Warns Bitcoin Mining Tax Will Drive Out Mining Farms In The U.S.

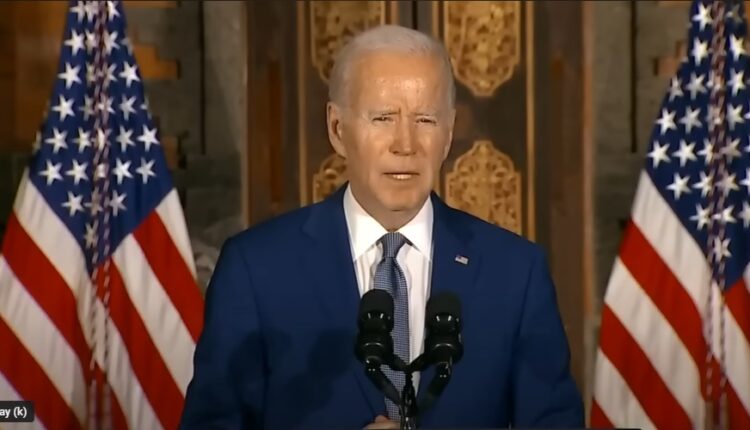

The White House insists on persuading the United States Congress to pass a 30% tax on the electrical energy used by Bitcoin miners. The so called Digital Asset Mining Energy (DAME) tax seeks to impose a stiff penalty for crypto mining—and specifically Bitcoin mining—in a effort to address ‘climate change’.

The proposal put forward since last year is advancing, according to a Yahoo News report that claims to have seen, in advance, a document that the White House is about to publish.

The proposed tax has drawn criticism from some industry insiders who claim it could harm the United States’ position as a global leader in the crypto-mining sector. Small and medium-sized miners may find it more challenging to compete with larger firms as a result of the levy, which may also result in less innovation in the sector.

The proposal, which does not specifically mention the possibility of banning digital mining in the United States, refers to the application of a special tax “on digital assets, mining and energy.” It is presumed the effect of passing such a measure would discourage Bitcoin mining in the United States, driving away the industry to other nations.

Many analysts believe this is the implicit goal, as cryptocurrencies provide transaction competition to the fiat U.S. dollar. Cryptocurrencies such as Bitcoin is also decentralized, which is a competitive advantage versus the centralized central bank digital currencies (CBDCs) the government seeks to impose.

Just last week, Texas Senator Ted Cruz cautioned against the introduction of one and its deleterious effects on Bitcoin, while expressing his “concern(ed) about the risk of a CBDC”. He also accused China of “moving forward with the intention of using a CBDC to destroy all the value of Bitcoin,” which is the same path the U.S. is headed towards with their FedNow service scheduled to begin in July.

While now a CBDC in of itself, it is the payment backbone of such a system the U.S. central bank desires to implement.

The U.S. Securities and Exchange Commission’s (SEC) has also issued several warning shots this year as it attempts to crack down on crypto. Specifically, it is attempting to expand the definition of what makes a securities exchange and defining crypto as securities.

And in a statement released by the Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and other US-based regulators in February, they warned local financial institutions about the risks that cryptocurrencies pose to liquidity. This is the second such statement released by the Fed and other regulators this year.