Stablecoin Ecosystem Breaks Down After TerraUSD Collapse

It appears the stablecoin ecosystem is not quite as stable as the term implies. Following TerraUSD stunning collapse on Monday—and even moreso today—a potpourri of usually reliable stablecoin pairs are taking it on the chin.

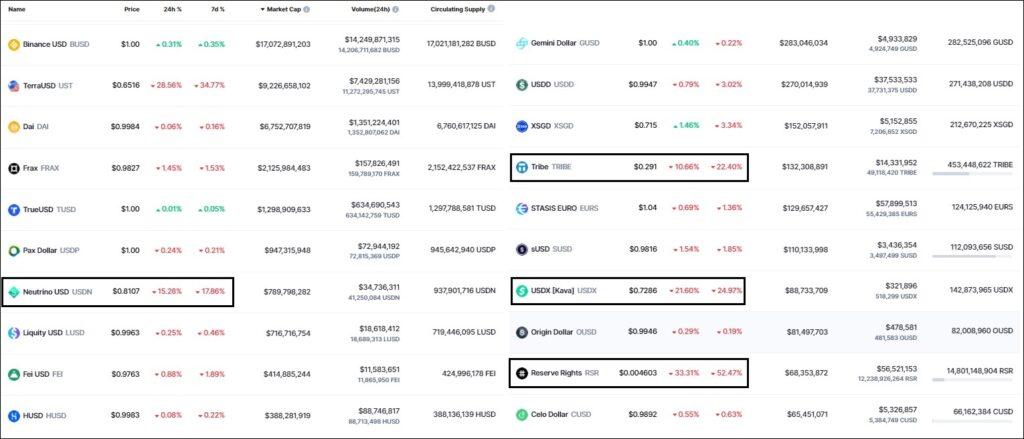

As at the end of the equity market trading session today, at least four other stablecoins experienced double-digit declines—excluding TerraUSD which plunged another 34.77% on Wednesday. And that was after paring much more ominous intraday losses.

The worst performer among the Top 20 stablecoins by market capitalization was Reserve Rights (RSV), which shed more than half of its value. The Reserve Protocol utilizes a basket of smart contract-managed cryptocurrencies to maintain its value. The project launched using USD Coin (USDC), TrueUSD (TUSD), and Paxos Standard (PAX), with the idea that eventually, a much more diverse crypto asset pool would secure RSV’s value. Ironically, the protocol was built to provide a low-volatility alternative to the centralized fiat currencies of today—which we suppose is still true if we’re talking the Russia ruble or Zimbabwe dollar.

Another poor performer was USDX (Kava), which is the native stablecoin of the Kava Ecosystem. The software protocol that uses multiple cryptocurrencies allowing users to borrow and lend assets without the need for a financial intermediary. Kava users can acquire USDX by supplying crypto assets to the Mint protocol as collateral. USDX denominates the borrow balances drawn from the Mint protocol. Although USDX is not directly pegged to a value of $1 U.S. dollar, it does have market flow stabilizers which can be affected by Kava Governance. Unfortunately, the stabilizers wilted under market pressure, and the stablecoin finished down almost twenty-five percent.

The last sub-twenty percent swoon among the Top 20 most capitalized stablecoins occurred in TRIBE. which is an Ethereum token that governs Fei Protocol, which issues a separate decentralized stablecoin called FEI. The Fei Protocol was designed to creates a tight peg by providing US$1 redeemability for FEI using something called Protocol Controlled Value (PCV)—an algorithm that allocates assets in PCV to provide liquidity and earn yield. TRIBE token holders manage the PCV, backing FEI with a community-owned reserve. According to coinmarketcap.com, TRIBE was lower by 22.40% at approximately 4:00pm EST today.

For those new to this asset class, stablecoins are a class of cryptocurrencies that strive to offer price stability by tethering its value to the U.S. dollar. Commonly, their value is derived through the purchase of reserve assets (fiat money currency, gold etc) that provide foundation for the value of the coin. Because stablecoins generally provide a reliable peg ratio to the U.S. dollar, they’ve gained popularity among crypto investors and asset managers not only for the stability the provide, but as a speedy and efficient way to transact in the emerging Web 3.0 investment landscape. Investors can frequently can earn rewards simply by holding dollar-pegged stablecoins in accounts on a decentralized exchange—much like fiat interest in a traditional bank account.