Sweden’s Riksbank Publishes Third Phase Of CBDC E-Krona Pilot Report

Riksbank has been exploring the development of a retail central bank digital currency (CBDC) through technical tests since 2020. The Swedish central bank recently published a report on its third phase of CBDC trials, which focused on investigating the role of intermediaries such as payment providers and banks in developing CBDC solutions. Additionally, the tests involved programmable payments and cross-border payments trials.

The project, now in its third phase, followed a previous pilot where the central bank tested several aspects of an e-krona network environment with authorized participants. This phase of the project investigated what an intermediated model with market participants would look like and how it could contribute to innovation in the payment market. To construct the modelling analysis, Riksbank collaborated with Norges Bank, the Bank of Israel, and the Bank of International Settlements (BIS) on Project Icebreaker, a cross-border CBDC research project that was recently completed.

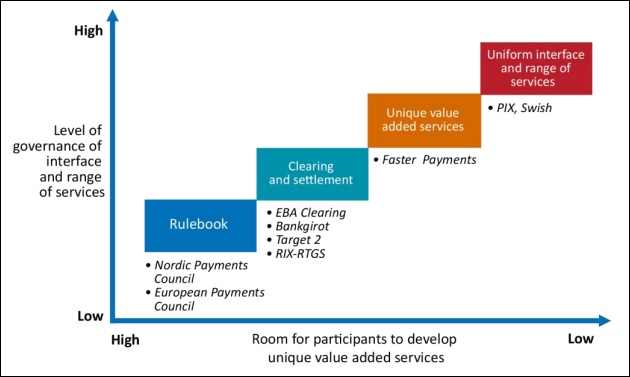

The degree of collaboration between the central bank and market participants will be an important decision for a future retail CBDC in Sweden. The pilot studied three degrees of governance and control, ranging from low, with participants having greater freedom to design unique services and interfaces, to very high, where they would have to comply with a standardized interface and service offering as defined by the central bank.

Another important aspect of a future e-krona will be programmability. Riksbank has been carrying out tests in this area to learn more about how technical solutions might benefit customers. For now, the bank is talking of conditional payments, as opposed to conditional money, to avoid misperceptions about government control that could erode trust in the system.

The Riksbank fears that as cash usage declines, it could “find it more difficult to fulfill its task of promoting a safe and efficient payment system accessible to all groups in society.” Thus, the e-krona project aims to maintain the central bank’s direct role in the payment market with a retail CBDC for the general public. Future work will focus less on technical aspects and more on the design features ahead of a possible decision on issuance.

The technical work of this third phase was based on R3‘s enterprise blockchain, Corda, with Accenture acting as the technology partner. Riksbank has not made any formal decisions regarding issuance, design, or technology for the e-krona.

However, if eventually enacted, Riksbank would distribute the e-krona to the public with the help of payment service providers and phase-out the current fiat money paradigm in parallel.