Boomers. Are they actually OK?

OK, BOOMER! This expression started receiving a lot of awareness in 2019 as a dismissive and sarcastic reply aimed at the baby boomer generation for virtually any opinion or comment from this group. Since this article is about Real Estate, we’ll keep our focus there and try to leave out the sarcasm. Numerous articles have been published about the baby boomers possessing a large amount of the existing Real Estate Wealth, but before we go down that road, let’s clarify the generations. The Silent Generation were born between 1928-1945 and this year they will be 75-92. The Baby Boomers, the stars of this article, were born between 1946-1964 and will be 56-74 this year. The next group coming up the ladder is Generation X (often forgotten in many discussions and lumped in with the Boomers), who were born between 1965-1980 and will be 40-55 this year. The final group are the Millennials, born between 1981-1996. Now that you’re familiar with the players, let’s discuss Real Estate.

COVID19 is having a major impact on so many things in life. It is almost impossible to list everything that’s been affected by this pandemic. A major worry around the globe is real estate values, and the Baby Boomer generation, in particular, is growing quite concerned. This generation has a 78% rate of homeownership, compared to Millennials who show a 37% rate of homeownership. This statistic alone is a source of friction between these two demographic groups, but let’s not get into that right now.

Let’s get back to why the Boomers are so specifically worried at this time. As the homeowners in this generation approach retirement age, they typically regard their home as their greatest asset. Some have successfully paid off their mortgage, others may be carrying a very small debt load. In most cases, they are sitting on a large amount of equity. But before we get to the equity equation, let’s examine the see-saw battle this generation has faced in the past decade. The market lunged forward and stumbled back on several occasions, and for many, the idea of retiring or cashing out and downsizing had to be put on hold; often more than once. The market meltdown in the United States in 2008-2009 produced a ripple effect that was felt throughout the world, and many Real Estate markets checked up and declined due to the arrogance of the lending institutions in the US. This was also the time that many people were contemplating retirement. The first wave of Baby Boomers were in their early 60’s, and the thought of retirement was now very much on their radar. When the Real Estate and financial markets began taking a dive, many had to recalculate their plans. Perhaps they may have to stay in their home a while longer, hoping values would return and a large number of people did just that. While they were waiting for the recovery, many decided to continue working and skip the early retirement plan. This became a hot button topic in the younger cohorts. “How dare the boomers continue to work and not free up their jobs for us?”. Naturally, this was not the intention of the Boomers, but the spin was in. As mentioned above, another source of friction seemed to be “How dare those boomers stay in those homes they don’t need anymore, and why aren’t they selling them to us?” Once again, this is a whole other article.

As property values started to recover from 2010 through 2013, we did begin to see some of the older homes coming on the market. This triggered the next wave of Real Estate recovery. Millennials began to purchase their first homes, which allowed first-time sellers (move-up buyers) to purchase their next home. Generally speaking, this is the standard progression of all real estate markets; they are fueled by the first time home buyer. One important caveat here is that not all markets are in sync. Sometimes, a market can be doing well in one area of the country while on the opposite side, a market can be in a downturn. There are few major influences that can make this happen, which again, is a subject for another article. The interesting fact here is that in 2015, the majority of the main real estate markets around the world were in sync. However, concerns were percolating in the background that some markets were starting to overheat. Thus began the next wave of activity, as the Silent Generation had reached their limit of time in their homes, and some of the Baby Boomers wanted to cash out.

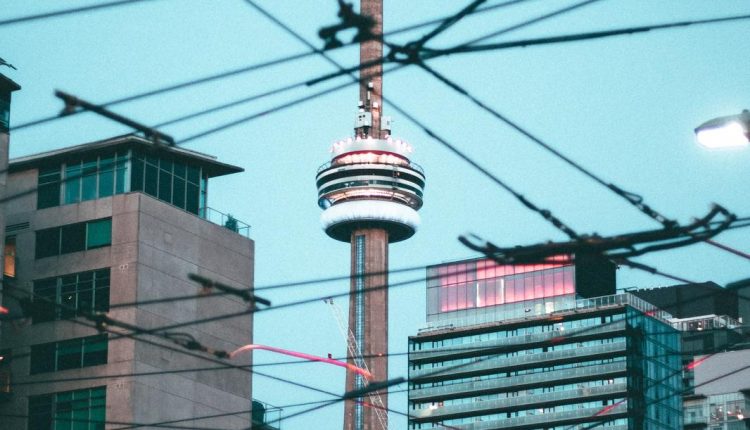

The markets began to heat up significantly, and as selling prices began to climb in double-digit fashion, those in the older demographics who had been waiting decided that now was the time to sell. To add even more fuel to the fire, Canada began to see an increase in the number of foreign buyers. On the west coast, people were blaming Chinese foreign investors for uncontrollably driving up the housing market. In Toronto, Canada’s largest city, people were arriving from all over the world to settle and become a part of the Canadian dream. Over the next 12 months, prices started to escalate in a very unsettling fashion, but for those ready to leave the market, the timing could not have been better. Many from the Baby Boomer generation were able to exit the market with a large return on their lifetime investment, which would now help keep them comfortable through their retirement years.

But then, it happened. The one thing most Real Estate experts fear… government intervention. I am not going to blame the millennial generation for the government changing things, but they sure did complain enough that any party leader knew they had to react in some fashion. British Columbia led the charge in August of 2016, implementing the foreign buyer tax. Within a few short weeks, their market came to a grinding halt. That soon-to-be-retired couple who had pinned their hopes on selling their home for a substantial price? They just had a bucket of cold water thrown on their dreams. Now they would have to wait longer to see what the market would do.

Over in Ontario, the intervention wasn’t immediate. It wasn’t just the perception of foreign buyers showing up with bags of cash that helped fuel the market, which no doubt, happened on occasion. The Ontario market had been heating up in other ways with speculative plays, low-interest rates and insufficient inventory combining to push prices and with it, prospective buyer’s patience, to the limit. Prospective buyers began tiring of bidding wars, which could propel selling prices sky-high. By the spring of 2017, the Ontario government had seen enough and decided to follow BC’s lead. A foreign buyer’s tax was levied with no warning at all. In fact, it happened the very next day following the announcement. In my opinion, this was a horrible decision which, to myself and many in the business, looked a lot like vote-buying. By pandering to one generation, they were adversely affecting another. At the same time, the Bank of Canada decided that upward pressure on interest rates would also be an important tool in regulating the market. For Boomers who did manage to sell their homes in the spring of 2017, many were just hoping their deals would now close. However, the real deal-breaker was just around the corner in the early weeks of January 2018.

The Federal Government had decided that Canadians were not capable of managing their debts, and implemented a mandatory mortgage STRESS TEST. This meant that all buyers would have to qualify for their loans at a 2% higher interest rate. The problem with this move? No grandfathering on purchases. Anyone who had signed a purchase agreement prior to this new rule coming into play, but had not yet closed on the property, now had to re-qualify at the higher interest rate. The resulting damage was felt across the country. This was devastating to some purchasers and the sellers ended up losing their sale. Buyers either renegotiated for a lower amount or walked away from the deal altogether. In some markets, people saw prices drop significantly and in others, completely go flat. If the stress test accomplished one thing, it took the fire out the market and the volume of home sales dropped by more than 30%…and this was before a global pandemic came along.

The market continued to sputter along for most of 2018 and the first half of 2019. First time home buyers started to come off the fence and people started to accept the new norm of the government’s involvement and growing influence on our finances. The Baby Boomers homes were in a market that was mostly neutral, save for a few boutique neighbourhoods that were always resilient.

Then finally, the lights came on. Right around June of 2019, the market started to show life. The Condominium market had really not faltered as much as predicted and began to pick up steam. The next wave of first-time buyers, many of them Millennials, wanted to get into the market. To try to entice them, the Liberal Party tried to seduce this next wave of buyers with their offers of up to 10% towards the down payment. No, it wasn’t free money. Yes, the Government would become part OWNER of your property. This particular boondoggle of a plan landed with a huge THUD. Very few liked the idea of sharing ownership of their home with the Government. Many first time buyers turned instead to family to help achieve their homeownership goals. The fall market of 2019 was showing some serious life for our Baby Boomer sellers. Prices began to inch up once more and sales year over year were on the rise. Could the Boomer generation start making a comeback in their real estate values?

Rolling into 2020, it sure felt that way. Houses started popping up here and there and the sale prices were getting stronger. Industry experts were forecasting price and volume increases for the coming year. Frustrated buyers were not going to be denied any longer and sellers were starting to see prices that were more palatable in many markets. In the background, we started hearing early rumblings from overseas regarding a virus but at the time, China’s problems seemed irrelevant. In February, things began to really gather steam. Multiple offers, prices starting to jump, heck even my wife and I sold our house in mid-February. We had purchased a new home in December just before the market picked up and thought we had timed it perfectly. Truth be told, we were lucky in our timing. The pandemic was just beginning to unfold in Europe, and not having much of an effect on the real estate market….yet. We watched as many of the Boomer generation finally put their homes on the market and within a few days, they were sold. The market was swinging back, and the predictions were starting to pile up. Could it be we were seeing a return of the 2016 run-up? It certainly started to look that way and those who had been on the fence to sell the family home and retire began reaching out to Realtors to get evaluations and get their homes on the market. This would finally be the year; some had held off for the last 3 years waiting for the market to come back a little and it was finally time. Then the totally unthinkable happened. A global pandemic that would bring the world to its knees and place the dreams of many on an immediate hiatus.

So here we are today, the world sitting in neutral, unsure which way to turn or go. If we open up too soon, we could risk a new wave which could have catastrophic health and financial implications…….but let’s be real, the world has already had a catastrophic health and financial bludgeoning. However, looking at real estate as a whole, it is still maintaining its strength and value. Perhaps like food, housing has become even more important to humanity. For the Boomers who currently own their homes, and many have for a very long time, perhaps you can take some solace in the fact that the home you took such good care of for so many years is now taking care of you in a very uneasy time. Perhaps it is not ideal that any plans you may have had for moving on have to be sidelined. For some, their home has never been more valuable to them then it is right now. Home is the place that you and your family feel the safest and maybe, just maybe, that is worth more than a few extra thousand in a sale price. Perhaps that feeling is priceless! Rest assured, the next generation will get their chance for ownership, and perhaps will feel differently about holding onto properties and building values when they do. But for now Boomers, you are going to be OK!

Todd C Slater is a Top Real Estate Expert. He is President of The Simple Investor and The Simple Landlord and Host of the #1 Real Estate Talk Show in Canada – Simply Real Estate on Newstalk 1010.